TL;DR

- Canary Capital’s XRP ETF secures $245 million in early inflows, marking one of the strongest starts for a crypto-linked fund in 2025.

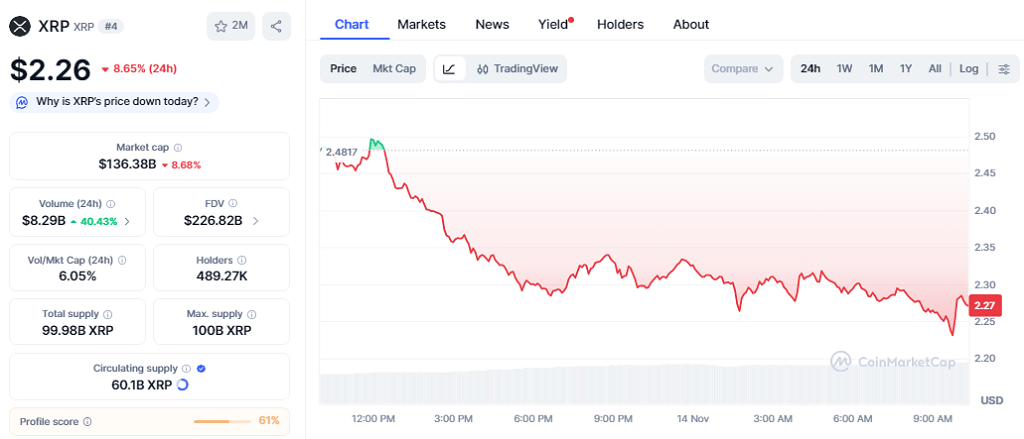

- Despite this demand, XRP trades at $2.26 after falling 8.65%, revealing that ETF enthusiasm has not yet translated into spot strength.

- Analysts highlight that institutional desks are using the ETF to rebalance exposure and manage baskets, delaying any short-term price impact.

Canary Capital’s XRP ETF continues attracting significant attention after pulling in $245 million during its debut window, setting a high benchmark for XRP-linked investment products. The launch arrives as digital-asset markets show renewed selling pressure, creating a contrast between strong ETF participation and restrained spot performance across several major tokens.

Early Momentum For The XRP ETF

Trading activity around the XRP ETF shows that investors remain eager to engage with large-cap assets beyond Bitcoin and Ethereum. The fund’s first sessions on Nasdaq delivered consistent liquidity supported by institutional desks and market makers anticipating broader access to regulated XRP exposure. ETF analysts indicate that part of the inflows comes from sophisticated traders who arbitrage intraday spreads and manage short-lived creation and redemption baskets. This strengthens overall liquidity but may soften the immediate influence on the underlying token.

Retail participation is also present. Advisors report that XRP is one of the most recognized digital assets among everyday investors, which helps explain the strong early interest. Several U.S. brokers integrated the ETF into their product menus within its first session, expanding access for smaller portfolios nationwide. Industry researchers add that the debut reflects a growing tendency among investors to diversify into assets with established payment-focused utilities, particularly in cross-border settlement environments.

Market Reaction And XRP Price Dynamics

XRP price action moves differently. The token trades at $2.26, falling 8.65% over the past day, even as twenty-four-hour trading volume climbs 40% to $8.29 billion. Market cap stands at $136.38 billion. Analysts attribute the pressure to broad altcoin weakness and elevated leverage, with traders reducing exposure across several majors. Technical indicators confirm a break below key near-term support levels, suggesting sellers remain active despite the ETF’s strong entrance into U.S. markets.

Market strategists believe that the gap between ETF inflows and spot performance could narrow if flows remain steady. They argue that continued institutional access and growing interest in regulated XRP exposure may support medium-term stabilization once volatility eases across major digital assets. For now, the XRP ETF marks a relevant development in structured crypto investment tools.