TL;DR

- The launch of Ripple USD (RLUSD) on exchanges marks a milestone after overcoming many legal obstacles, offering a new stablecoin.

- RLUSD facilitates fast and cost-effective global payments, supported by the XRP and Ethereum blockchains, and is designed for both businesses and everyday users.

- XRP’s price increased by 8% following the launch of RLUSD, but the massive influx of $115 million in XRP to exchanges could generate selling pressure.

The launch of Ripple USD (RLUSD) on various exchanges has finally been realized. This launch comes after a long process filled with legal hurdles, but the stablecoin has now been presented as an alternative for users and businesses in the crypto market.

Ripple USD has been designed as an enterprise-grade stablecoin that combines the stability of the US dollar with the efficiency of blockchain. Its value is backed 1:1 by a reserve of cash and cash equivalents, ensuring it maintains a constant parity with the dollar. This new stablecoin is available on both the XRP Ledger and the Ethereum blockchain, providing users with access to instant payments 24/7.

One of the most important features of RLUSD is its ability to facilitate fast and economical global fund transfers, a key advantage for businesses that need to send money around the world. Additionally, it allows users to interact with real-world assets through its integration with the aforementioned blockchains, strengthening its appeal to both regular users and large corporations.

Ripple Reaps Success in the Market

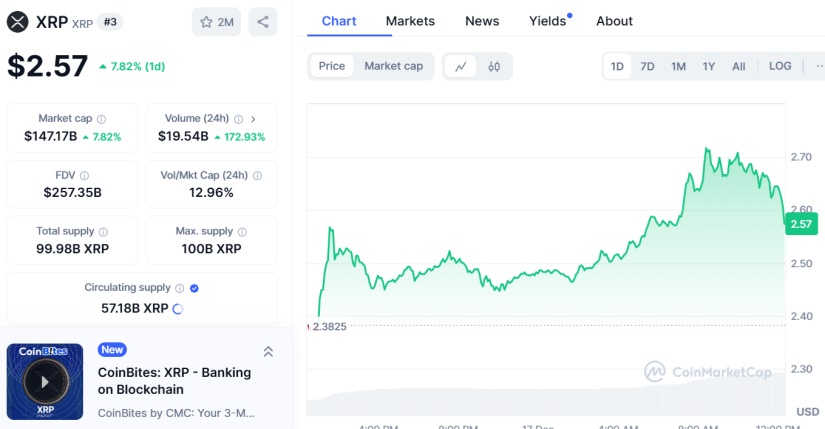

The launch has had a strong impact on the value of XRP, Ripple’s native token. XRP’s price initially surged by 13%, and after a slight correction, it settled at around 8%, with a price of $2.57 per unit. Moreover, there was a significant increase in transaction volume, which rose by 173%, showing high investor interest in the token.

However, this good news for Ripple could have a dark side in the short term. According to Coinglass’ analysis, there has been a flow of $115 million worth of XRP onto exchanges. This massive influx of tokens onto platforms could signal potential selling pressure, suggesting that, despite the progress with its stablecoin, XRP could face a price decline in the coming days.