TL;DR

- The lawsuit between the SEC and Ripple is nearing resolution, with ongoing negotiations over the terms of an August ruling.

- Ripple seeks more favorable conditions in the ruling, arguing that if the SEC offers a “fresh start” to other crypto companies, the same treatment should be applied to the firm.

- The delay in resolving the case is due to the lack of clear precedents for handling changes in the SEC’s approach, which is prolonging the process.

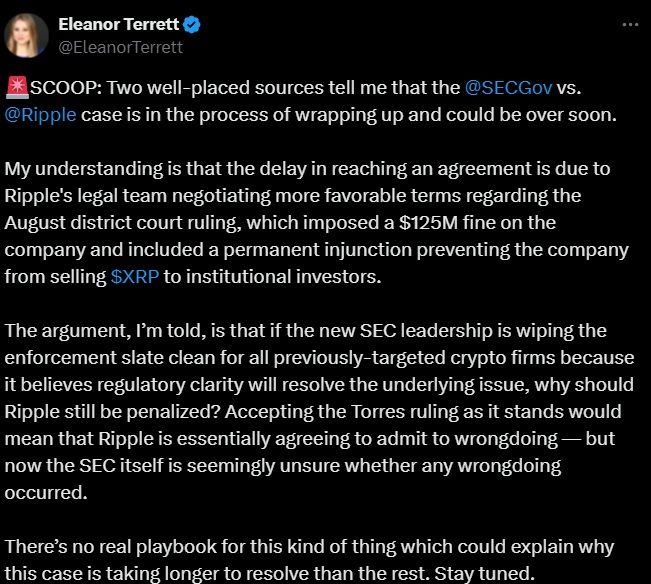

The lawsuit between the U.S. Securities and Exchange Commission (SEC) and Ripple Labs is coming to an end, according to sources close to the case.

The ongoing negotiations focus on the terms of an August ruling, which ordered Ripple to pay a $125 million fine and imposed a permanent ban on the sale of XRP to institutional investors. However, the resolution has been delayed due to discussions about the scope of the ruling, opening the door for a potential settlement.

Eleanor Terrett, a journalist for FOX Business, reported that the main reason for the delay in reaching a settlement is that Ripple’s legal team is seeking more favorable terms regarding the court’s decision.

Ripple Wants Fair Treatment Based on New Conditions

According to her sources, the company argues that if the new SEC leadership is offering a “fresh start” to other crypto firms, the same treatment should be applied to Ripple, avoiding penalties based on past regulatory uncertainty. Ripple maintains that accepting the August ruling would mean admitting guilt for an act that now seems to be under reconsideration by the SEC itself.

Terrett also highlights that, although negotiations continue, Ripple seems to be struggling to modify parts of the ruling that affect its ability to operate. Among the company’s concerns are securities law violations, especially related to XRP sales to institutional investors, and the order prohibiting those transactions in the future. In this sense, the company is negotiating to avoid these restrictions from impacting its long-term plans.

An Unprecedented Turn

The delay in the case has been significant, partly because there is no clear precedent for handling situations where the regulator has changed its stance, as has happened with the SEC and other crypto companies. According to Terrett, this could explain why the case is taking longer than other similar cases. The uncertainty about whether the SEC believes Ripple made a mistake has further prolonged the process.

Although not everything has been settled yet, this case has the potential to set an important precedent in cryptocurrency regulation in the United States, as it could redefine how the SEC interacts with companies in the sector. The crypto industry hopes that resolving this conflict will provide greater clarity about the future of regulations in the country