TL;DR

- Through its ETF, BlackRock manages 781,160 BTC and surpasses the reserves of Coinbase and Binance, ranking only behind Satoshi Nakamoto.

- Bitcoin held in ETFs is removed from circulation, creating a supply shock.

- BlackRock manages over $100 billion in crypto assets, while Fidelity competes with 199,127 BTC and 728,939 ETH.

BlackRock has just become the world’s largest known Bitcoin holder thanks to the expansion of its iShares Bitcoin Trust (IBIT).

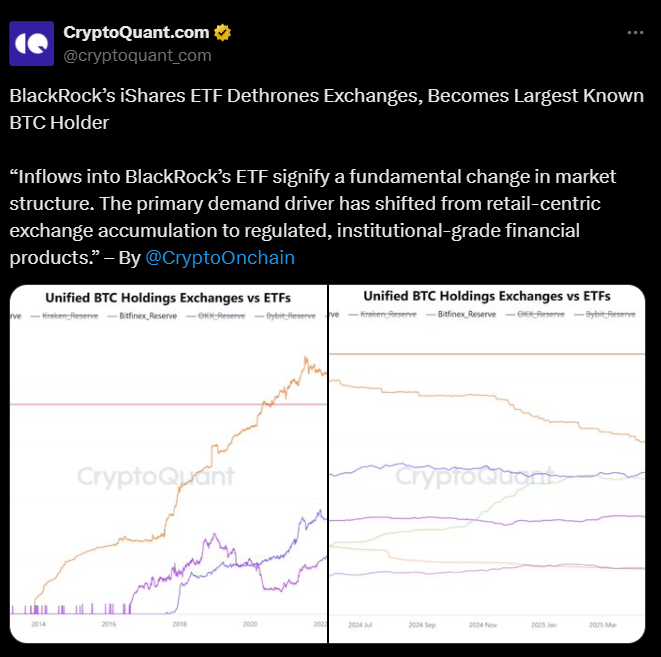

The financial vehicle has overtaken the reserves of major exchanges and consolidated a dominance that reflects how investors are changing their way of accessing the crypto market. The latest data from CryptoQuant shows that IBIT holds around 781,160 BTC, placing it ahead of Coinbase with 703,110 BTC and Binance with roughly 558,070 BTC. Only Bitcoin’s creator, Satoshi Nakamoto, retains a larger stash, estimated at 1.1 million coins untouched since the network’s early days.

Supply Shock and Price Stability

The key difference between exchange-traded funds and trading platform reserves is that Bitcoin held within ETFs becomes immobilized. This reduces circulation in the open market and triggers what many analysts describe as a supply shock. Fewer coins available mean greater difficulty for new buyers and a more supportive environment for price stabilization. At the same time, the decline in exchange balances suggests that more investors are turning to regulated and custodied products instead of direct storage on platforms or private wallets.

The rise of IBIT follows BlackRock’s confirmation on August 14 that its digital assets had surpassed $100 billion. At that point, its portfolio included $89.27 billion in Bitcoin, equal to 743,310 BTC, and $14.71 billion in Ethereum, totaling 3.2 million tokens. This rapid growth reflects the firm’s ability to attract large-scale institutional inflows in a market historically dominated by retail trading.

BlackRock Leads, But Not Alone

Other asset managers have taken a similar path to BlackRock. Fidelity has also expanded its crypto-linked funds. Its two flagship ETFs, the Fidelity Bitcoin ETF and Fidelity Ethereum ETF, reached 199,127 BTC and 728,939 ETH, valued at $25.92 billion as of August 20. Since January, the firm has added $5.37 billion in exposure, mainly in Ethereum, whose holdings have risen 62% in just eight months.

BlackRock and other large financial institutions are absorbing a growing share of digital assets. The shift toward ETFs is progressively displacing exchanges as central custodians, marking a turning point in the structure of the Bitcoin and Ethereum market