TL;DR

- BlackRock is facing its first significant redemptions in its Bitcoin ETF, IBIT, after months of market dominance, having sold around 544 BTC.

- The sale coincided with Bitcoin dropping below $105,000, triggering concern among institutional investors and a $150 billion decline in BTC’s total market capitalization.

- Despite the volatility, IBIT remains the leading spot Bitcoin ETF, outperforming competitors such as Fidelity, Grayscale, and VanEck.

BlackRock is dealing with the first major redemptions in its Bitcoin ETF, the iShares Bitcoin Trust (IBIT), following months of institutional market dominance.

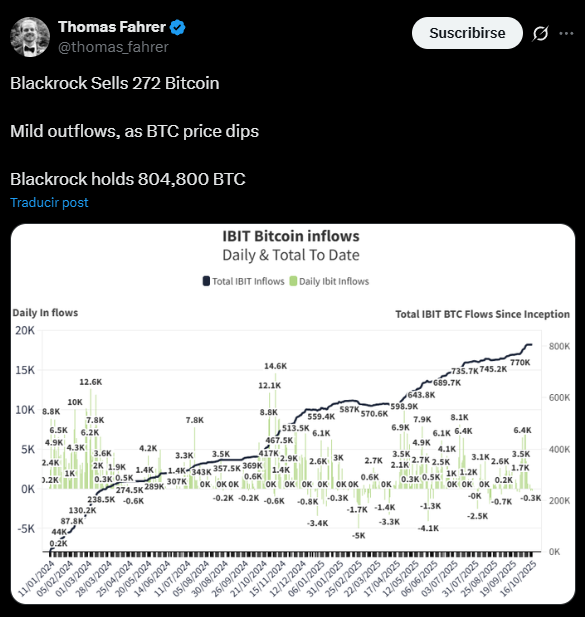

Over a two-day period, the fund sold 544 BTC, worth roughly $57 million. Although these outflows represent only a fraction of its reserves, which total approximately 804,800 coins, they coincided with Bitcoin’s drop below $105,000, raising concerns about a potential shift in institutional sentiment toward the crypto market.

The impact extended across the market. Bitcoin’s total market capitalization fell by nearly $150 billion in 24 hours, wiping out much of the late-summer gains. U.S.-listed Bitcoin ETFs experienced their largest collective outflow since August, with over 4,800 BTC—equivalent to $530 million—withdrawn in a single day.

This pressure was compounded by a tense macroeconomic backdrop, marked by Donald Trump’s renewed threats of 100% tariffs on China, which triggered waves of selling across risk assets, strengthened the dollar, and pushed gold prices above $4,300 per ounce.

Can Bitcoin Fall Further?

Bitcoin broke below its 200-day moving average near $107,400 and tested support around $99,500, confirming the market’s technical vulnerability and raising fears of a deeper correction. Technical analysts view that region as the last major support before a potentially prolonged bearish move.

Despite the Shock, BlackRock Remains the Absolute Leader

Despite the volatility and redemptions, BlackRock and IBIT remain clearly dominant among spot Bitcoin ETFs, surpassing competitors such as Fidelity, Grayscale, and VanEck. Its asset base demonstrates that BlackRock is the primary reference for institutional Bitcoin exposure, even as the current situation shows that even the largest players are not immune to market fluctuations and geopolitical factors.

The wave of selling and price decline highlights widespread nervousness among institutional investors and the crypto market’s sensitivity to macroeconomic and geopolitical events. For now, it remains unclear whether these redemptions signal a temporary pullback or the start of a deeper adjustment