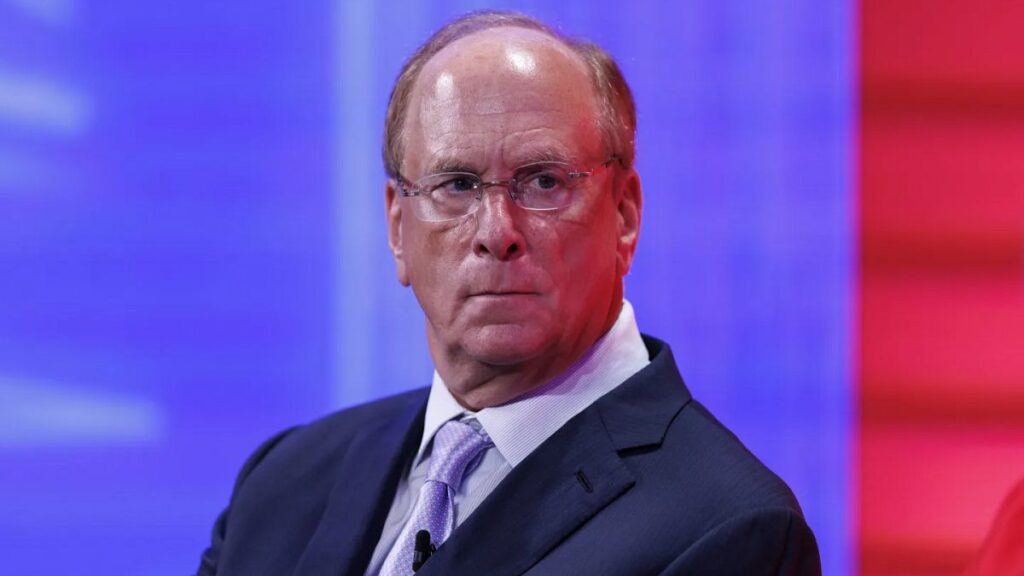

BlackRock CEO Larry Fink stated at the DealBook Summit that Bitcoin has become “an asset of fear,” referencing how geopolitical tensions and economic uncertainty continue to shape investor behavior, especially among large global allocators seeking resilient stores of value. His comments were made during an interview hosted by The New York Times, where he discussed the firm’s expanding exposure to digital assets.

Fink explained that Bitcoin’s growing role as a macro hedge reflects shifting global sentiment, particularly as traditional markets face persistent fiscal deficits and geopolitical volatility. While he acknowledged BTC’s historical stigma, he noted that institutional participation—driven in part by BlackRock’s own spot ETF—has strengthened market infrastructure, transparency, and long-term investor confidence.

The executive added that BlackRock will continue evaluating client demand and regulatory clarity to determine next steps for its digital asset products. No timeline was provided for future updates, though Fink indicated more disclosures may be shared in upcoming quarterly reports and future industry events.

Disclaimer: Crypto Economy Flash News are based on verified public and official sources. Their purpose is to provide fast, factual updates about relevant events in the crypto and blockchain ecosystem.

This information does not constitute financial advice or investment recommendation. Readers are encouraged to verify all details through official project channels before making any related decisions.