TL;DR

- Bitcoin records its second-largest whale accumulation of 2025 but fails to break above $106,000 amid sustained selling pressure from long-term holders.

- Glassnode identifies a heavy supply cluster between $106,000 and $118,000, where around 417,750 BTC act as natural resistance, capping any upward momentum.

- Sales from early holders like Owen Gunden and weak retail demand prevent BTC from consolidating a recovery toward $110,000.

Bitcoin has failed to break past $106,000 despite its second-largest whale accumulation of 2025. The buying rebound by large holders wasn’t enough to offset selling pressure from long-term investors or overcome a technical resistance that continues to block recovery attempts toward $110,000.

BTC rose 8.7% on Tuesday to $107,500 after hitting a four-month low of $98,900, but the move lost steam two days later. Following another correction, Bitcoin (BTC) trades below $99,700, down 2.1%. Data from CryptoQuant shows whales purchased over 45,000 BTC during the week, marking the second-largest accumulation wave of the year.

That activity mirrored March’s pattern, when whales bought the dip amid sharp declines, though the impact on price was limited. According to analyst Caueconomy, whales are absorbing capitulation from smaller investors, but the spot buying volume remains insufficient to sustain a rebound.

Long-Term Selling Prevents Bitcoin Recovery

Glassnode noted that the market needs renewed conviction and stronger retail demand to sustain a move above $106,000. The firm identified a dense supply cluster between $106,000 and $118,000, where many investors are looking to exit near breakeven. That zone includes around 417,750 BTC acquired between $106,000 and $107,200, creating a natural resistance barrier.

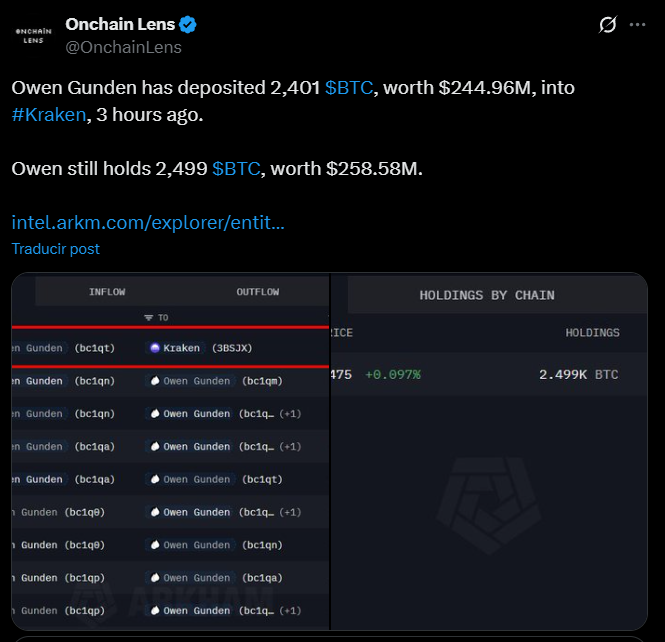

While whales continue to accumulate, early holders are still selling. Owen Gunden, one of the best-known early investors, transferred 2,401 BTC — about $245 million — to Kraken on Thursday, matching other long-term movements that suggest waning short-term confidence.

What Analysts Are Saying

Technical analysts agree that BTC must flip the $106K–$107K range into support to aim for a breakout toward $110,000. Daan Crypto Trades believes a close above $107,000 would bring BTC back into its bullish range, while CRYPTO Damus and Michael van de Poppe point to a clearer confirmation if the price holds above $108,000 or even $110,000.

For now, the latest whale buying wave isn’t enough. Bitcoin remains in a fragile range, with heavy supply at key levels and a demand side that still lacks the strength to regain control of the market.