TL;DR

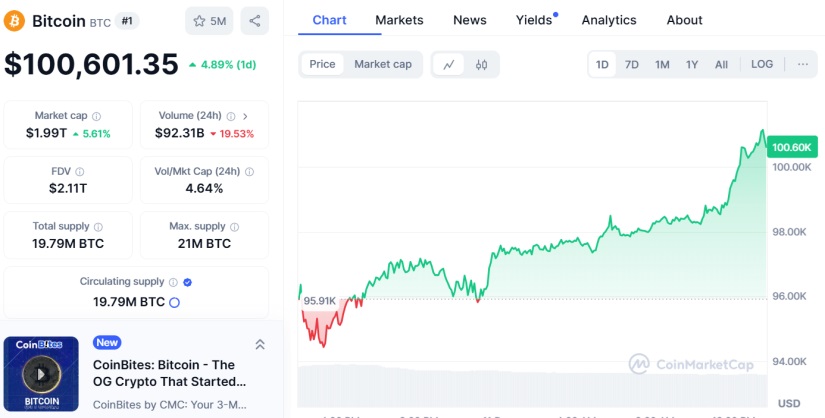

- Bitcoin surpasses $100,000 again, driven by U.S. inflation data, with a 4.89% increase in the last 24 hours.

- The rise in Bitcoin’s price has extended to other cryptocurrencies such as XRP, Dogecoin, and Solana, with a substantial rebound in their values.

- Bitcoin and Ethereum ETFs continue to attract investments, with a record flow of $3.85 billion into digital asset funds.

Bitcoin has surpassed the $100,000 mark once again, a level it had not reached since its recent all-time high of $103,679. The rebound was driven by U.S. inflation data.

In the last 24 hours, the largest cryptocurrency by market capitalization has experienced a 4.89% increase, and its value has been fluctuating around $100,500. The recovery comes after a drop below $95,000 on Tuesday, which triggered a series of liquidations of long and short positions, although BTC has managed to recover gradually since then.

Bitcoin Spreads Its Recovery Across the Crypto Market

The price increase has been supported by the release of the U.S. consumer price index (CPI) data, which showed a 0.3% increase in November, in line with analysts’ expectations. This inflation behavior has sparked speculation about a possible interest rate cut by the Federal Reserve, which could positively impact the crypto market, as investors tend to seek higher-risk assets in a lower interest rate environment.

ETFs Continue to Reap Rewards

Bitcoin’s recovery has also benefited other cryptocurrencies. Among them, XRP, Dogecoin, and Solana. XRP, which had fallen below $2.00 on Tuesday, has risen by 17%, reaching $2.44. Its rebound comes after the overall market recovery and the announcement from Ripple Labs about the imminent launch of its stablecoin RLUSD, with regulatory approval in New York. Meanwhile, Dogecoin and Solana have risen by 9%.

In addition, institutional interest in Bitcoin and Ethereum exchange-traded products (ETFs) has played a key role. According to a CoinShares report, a record $3.85 billion flowed into digital asset funds last week, with BlackRock leading the investments. This reflects an insatiable demand from traditional investors for exposure to the crypto market, a phenomenon highly favorable for the industry’s growth.