TL;DR

- On-chain analyst James Check forecasts Bitcoin could reach $150,000 in the coming months, supported by macroeconomic trends and historical metrics such as the MVRV ratio.

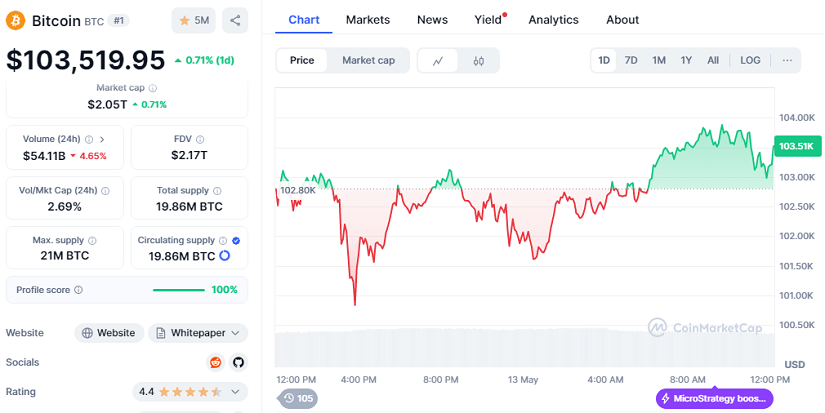

- Despite a recent correction, Bitcoin’s current price ($103,519.95) and market capitalization ($2.05 trillion) show signs of solid consolidation.

- The expanding role of derivatives and growing institutional interest are shaping a new stage of market maturity for BTC.

The Bitcoin market continues to surprise skeptics. After surpassing the psychological $100,000 mark, its current price stands at around $103,519.95, with a slight drop of -0.71% in the past 24 hours. Still, enthusiasm within the crypto community remains strong. On the contrary, several experts argue that the real rally may only be getting started.

One of the most optimistic analyses comes from James Check, a well-known on-chain analyst, who claims that Bitcoin’s price could climb to $150,000 in the coming months. His outlook is not based on speculation, but on solid data and macroeconomic signals pointing to a major shift in global financial flows.

Monetary Regime Shift And Bitcoin’s Role As A Safe Haven

Check believes we are entering a new era of sound-money dominance. Historically, gold has led the way in such cycles, but now Bitcoin is competing in the same arena. With a market capitalization of $2.05 trillion, Bitcoin has already overtaken silver and solidified its position among the world’s top five monetary assets.

This change coincides with a big shift in strategy among institutional investors, who now see Bitcoin not just as a speculative tool, but as a hedge against monetary distortions. The growing use of derivatives like futures and options is not diluting interest, instead, it’s enabling the inflow of serious capital by providing the infrastructure needed for large-scale participation.

Strong Consolidation And Statistical Outlook For The Rally

From a technical standpoint, Check emphasizes that the MVRV ratio, which compares market value with realized value, suggests the statistical ceiling for this current cycle lies around $166,000. Reaching $150,000 would not be an exaggeration, but rather a natural stage in investor behavior as unrealized profits begin to be locked in.

Unlike previous cycles, today’s corrections don’t appear as steep crashes. Instead, the market experiences what Check calls “time pain”, extended periods of sideways movement that emotionally drain the average investor. This market maturity shows that Bitcoin no longer relies solely on halving events to drive price action, but now reacts to broader macro variables like inflation, the dollar cycle, and asset rotation.