TL;DR

- Bitcoin options open interest now exceeds futures by $40 billion, reflecting greater sophistication and stability in the financial ecosystem.

- Options enable hedging, volatility trading, and structured products, helping reduce overall market volatility.

- Companies like BlackRock are driving institutional adoption, contributing to a more mature BTC market.

Bitcoin has experienced a structural shift in its derivatives markets: options open interest now surpasses futures by roughly $40 billion, signaling progress toward a more sophisticated and stable BTC financial ecosystem.

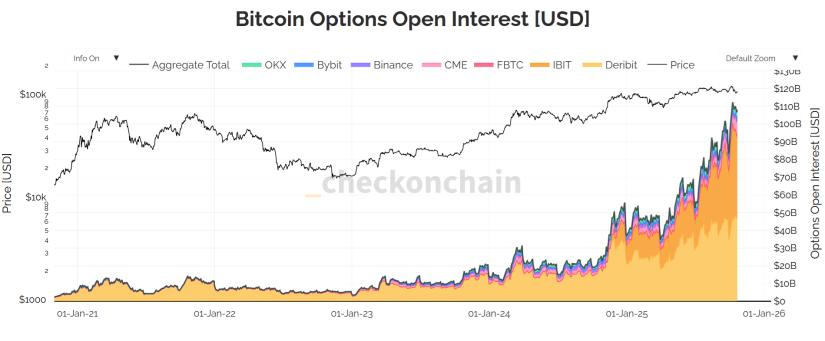

According to CheckonChain data, options open interest (OOI) stands near $108 billion, close to its all-time high of $112 billion, while futures open interest (FOI) is at $68 billion, significantly below its peak of $91 billion. This historic gap is partly explained by the contraction of leverage following liquidations that wiped out over $20 billion in futures positions.

What Bitcoin’s Options Market Offers

The options market provides functions beyond mere speculation: it allows hedging strategies, delta-neutral trading, volatility trading, and structured product creation. Unlike a large futures market, which typically generates higher leverage and the risk of massive liquidations, the growth of Bitcoin options has contributed to lowering overall market volatility. The recent 18% pullback from the all-time high to $103,000 was relatively contained, with the dominance of options cushioning the decline.

The expansion of the options market has also been catalyzed by regulated platforms, such as BlackRock’s iShares Bitcoin Trust (IBIT), which since its November 2024 launch has become the largest Bitcoin options platform, surpassing Deribit. Participation from institutions of this caliber encourages the adoption of more sophisticated hedging strategies and strengthens investor confidence.

A Structural Shift Toward Maturity and Trust

This structural shift, in which the options market becomes more dominant than futures, could reshape Bitcoin’s cycle dynamics. The expansion of options helps buffer bearish phases and smooth extreme movements during bullish periods, promoting greater overall market stability. The sustained rise in OOI also reflects the growing maturity of Bitcoin’s financial infrastructure.

The BTC options market consolidates the ecosystem’s transition toward more professional financial structures, reducing reliance on leverage and abrupt speculative moves that characterized previous cycles. The future points to a more mature Bitcoin and a stronger market for both institutional and retail investment