TL;DR

- Bitcoin’s hash rate reached a new all-time high, showing a recent strong recovery.

- The decrease in the hash rate coincided with a decline in mining difficulty, allowing miners to produce blocks faster.

- Despite immediate benefits for miners, it is expected that the blockchain will adjust difficulty in future changes, which could impact the hash rate.

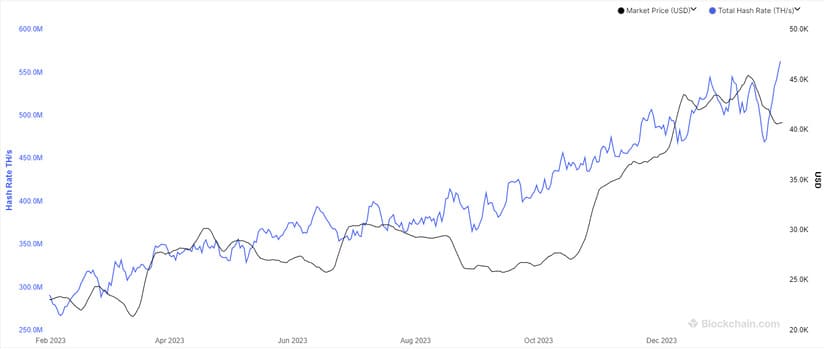

Bitcoin’s hash rate experienced a significant recovery in recent days, reaching a new all-time high. This metric, which tracks the total computing power connected to the BTC blockchain by miners, is a crucial indicator of interest and activity in mining.

Until recently, Bitcoin’s hash rate had encountered a marked decline, reaching its lowest levels in over two months. However, in a rapid and strong recovery, the metric not only fully recovered from this drop but surpassed the previous high, establishing a new record for the network.

The previous decline in the hash rate coincided with a decrease in mining difficulty, a mechanism in the Bitcoin blockchain that adjusts the complexity of mining to regulate the speed at which new blocks can be extracted. This decrease in difficulty allowed miners to produce blocks more quickly, creating an attractive opportunity for those involved in BTC mining.

The Increase in Bitcoin’s Hash Rate Would Be Contributing to the Recovery of Its Value

The Bitcoin network aims to maintain a rate of one block mined every ten minutes. When miners increase their hash rate, they become more efficient in mining and can produce blocks faster than the standard rate. In response, the blockchain recalibrates the difficulty in the next scheduled adjustment (which occurs approximately every two weeks), making it challenging for miners to return to the intended production pace.

The relationship between the decrease in difficulty and the drop in hash rate seems to have created an attractive opportunity for miners. This decrease allowed a significant amount of computing power to connect to the network, accelerating the block production rate and generating faster rewards for miners.

It is essential to note that, while this situation provides immediate benefits for miners, the blockchain will eventually increase difficulty in future adjustments, potentially causing a withdrawal of additional hash rate added during this period of lower difficulty.

At the time of writing this report, Bitcoin is gradually recovering from its decline, trading around $42,422, with a 5.4% increase in the last week. This price increase could be correlated with the improvement in mining activity and renewed interest in the BTC network.