TL;DR

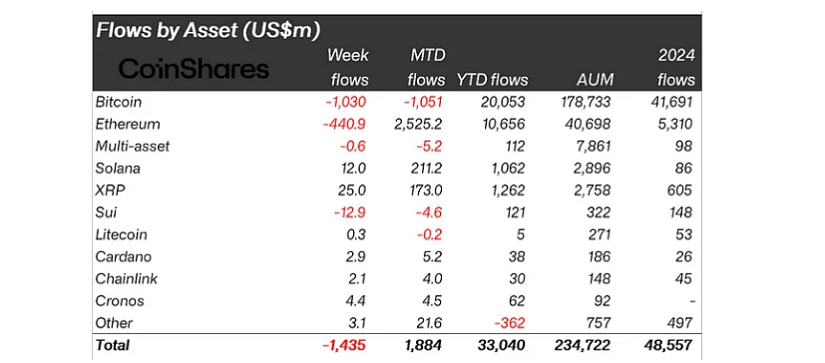

- Digital asset funds registered outflows of $1.43 billion, the largest since March, as investors reacted to shifting expectations on U.S. monetary policy.

- Bitcoin suffered $1 billion in outflows, while Ethereum limited losses to $440 million and continues to post $2.5 billion in inflows this month.

- Altcoins displayed a mixed performance, with XRP, Solana, and Cronos gaining, while Sui and Ton lagged behind with notable withdrawals.

Global digital asset investment products endured their sharpest setback since March, with a total of $1.43 billion exiting the market. At the same time, trading volumes in exchange-traded products climbed to $38 billion, around 50 percent above the yearly average. Analysts attribute the turbulence to heightened anxiety surrounding the Federal Reserve’s policy trajectory, a factor that has consistently influenced market flows throughout 2025.

Early in the week, pessimism about the Fed’s intentions drove outflows of nearly $2 billion. That trend reversed when Jerome Powell’s remarks at the Jackson Hole Symposium suggested a more cautious approach, sparking late inflows of $594 million. Still, the rebound was not evenly spread, with Ethereum showing more resilience than Bitcoin.

Ethereum Shows Stronger Investor Confidence

Ethereum managed to restrict outflows to $440 million, compared to Bitcoin’s $1 billion. More importantly, Ethereum has accumulated $2.5 billion in net inflows this month, while Bitcoin is down $1 billion in the same period. This divergence is significant, highlighting a shift in institutional preference. Ethereum’s broader use cases, such as decentralized finance and tokenization projects, appear to be attracting sustained capital even during market volatility.

Year-to-date, Ethereum’s inflows represent 26 percent of total assets under management, versus just 11 percent for Bitcoin. For investors focused on long-term growth and utility, this performance reinforces the idea that Ethereum is increasingly positioned as a key digital asset alongside Bitcoin, not just a secondary option.

Altcoins Display Mixed Market Momentum

The week also revealed contrasting dynamics among altcoins. XRP posted $25 million in inflows, Solana added $12 million, and Cronos secured $4.4 million. Meanwhile, Sui registered the heaviest outflow of $12.9 million, and Ton followed with $1.5 million in losses. Despite the uneven results, the overall activity signals that investors remain engaged with a diversified set of assets.

While Bitcoin continues to face challenges from shifting macroeconomic conditions, Ethereum and selective altcoins are demonstrating a more stable demand. This suggests that investors are gradually broadening their focus toward assets that combine utility, scalability, and institutional adoption, a trend that could strengthen as digital finance matures globally.