TL;DR

- Bitcoin ETFs recorded outflows exceeding $536 million, the largest in over two months, reflecting a sharp shift toward risk aversion.

- The impact concentrated on Ark & 21Shares and Fidelity funds, while BTC fell to $108,000 and ETH to $3,900.

- The sell-off is linked to the $20 billion global liquidation following Trump’s 100% tariffs on Chinese imports.

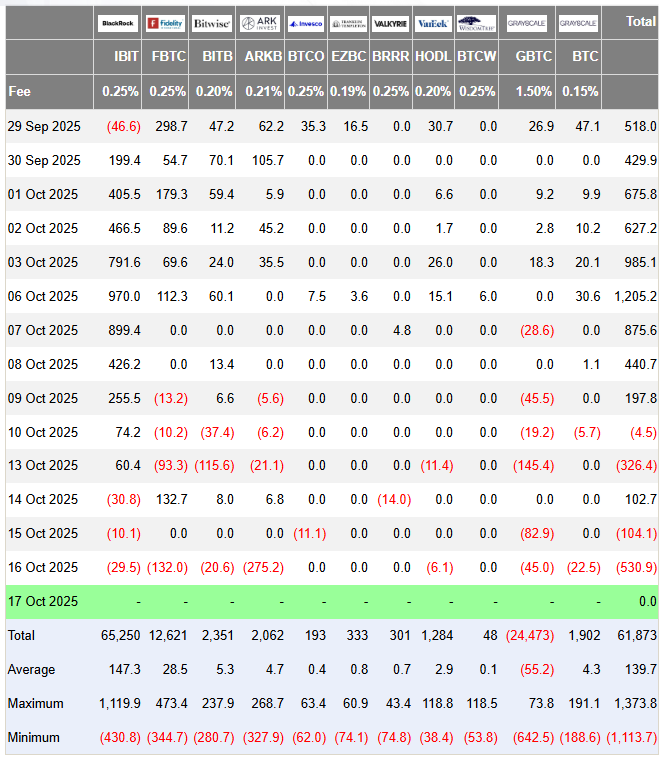

Bitcoin ETFs in the U.S. faced their worst day in more than two months, with withdrawals totaling $536 million, highlighting a drastic shift in risk appetite within the crypto market. According to Farside Investors, eight out of twelve ETFs registered redemptions, as volatility dominates amid geopolitical uncertainty.

The ARKB fund, managed by Ark & 21Shares, led the outflows with $275 million, followed by Fidelity’s FBTC, which saw another $132 million exit. Products from BlackRock, Grayscale, Bitwise, VanEck, and Valkyrie also recorded smaller outflows, indicating a widespread trend of reduced exposure.

Bitcoin Continues to Suffer from Trumpian Tariffs

The decline occurred just days after the massive $20 billion liquidation of leveraged positions, triggered by the White House’s decision to impose 100% tariffs on Chinese imports. The measure, pushed by Donald Trump, hit risk assets hard and sparked a new wave of forced selling in both traditional and digital markets.

Ethereum also took a hit, as funds reduced positions by $57 million, reflecting institutional retrenchment. BTC retreated to $108,000, while ETH fell to around $3,900, deepening the losses accumulated over the week.

The Correction Phase Extends

Analysts warn that Bitcoin ETF outflows could prolong the correction phase, although sustained easing of inflation or a shift in monetary policy could revive demand by year-end. Justin d’Anethan, head of research at Arctic Digital, noted that the market is trying to stabilize but remains caught between restrictive policies and the impact of trade tensions.

For now, the message from ETF flows is clear: investors are de-risking, volatility has returned, and the crypto market’s recovery is once again on hold.