TL;DR

- Bitcoin ETFs recorded $676M in inflows over three days, fueled by institutional capital after September’s correction.

- BlackRock’s IBIT topped the charts with $405M in a single day and has accumulated $61.38B, while Fidelity’s FBTC added $179M, bringing its total to $12.46B.

- Ethereum ETFs took in $80.9M, led by FETH with $36.8M and ETHA with $26.2M, alongside ETH’s rebound above $4,400.

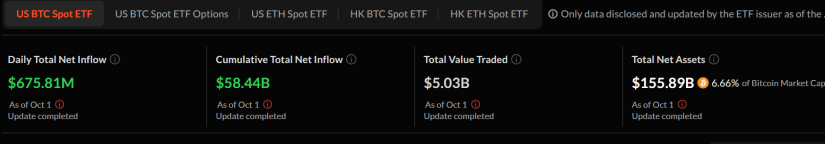

Bitcoin exchange-traded funds (ETFs) attracted $676 million in net inflows, extending a three-day streak of positive flows.

The rebound reflects a clear return of institutional appetite after the late-September correction and positioned BlackRock and Fidelity as the main recipients of capital in this segment of the crypto market.

Institutions Back in Play

BlackRock’s iShares Bitcoin Trust (IBIT) brought in $405 million in a single day, the highest figure in the market. The fund has accumulated $61.38 billion in net inflows since launch and manages $90.87 billion in assets, with a 0.25% fee. During the session it traded 57.8 million shares and generated $3.85 billion in volume, keeping it the most liquid and dominant spot Bitcoin ETF in the U.S.

Fidelity’s Wise Origin Bitcoin Fund (FBTC) ranked second, attracting $179 million in daily inflows. The fund has now accumulated $12.46 billion in inflows and manages $24.12 billion in net assets, supported by a trading volume of $508 million.

Other players posted smaller but steady figures: Ark Invest’s ARKB added $5.86 million, reaching a total of $2.28 billion, while Grayscale’s new vehicle attracted $9.88 million. Even the long-standing GBTC, which has seen $24.13 billion in outflows since converting from a trust, managed a modest inflow of $9.22 million.

Ethereum and Bitcoin on the Rise

Bitcoin’s price responded positively to the inflows. At the time of publication, BTC was trading near $119,700 per coin, up 2.1% on the day.

Ethereum ETFs also attracted fresh capital, though on a smaller scale. ETH funds pulled in $80.9 million in net inflows, led by Fidelity’s FETH with $36.8 million and BlackRock’s ETHA with $26.2 million. VanEck contributed $14.3 million and Grayscale’s ETHE added $3.6 million, while other products saw no significant activity.

Ethereum also delivered a strong market performance, trading above $4,400, up 2.15% on the day. Its market cap reached $533 billion with $44.37 billion in 24-hour trading volume