TL;DR

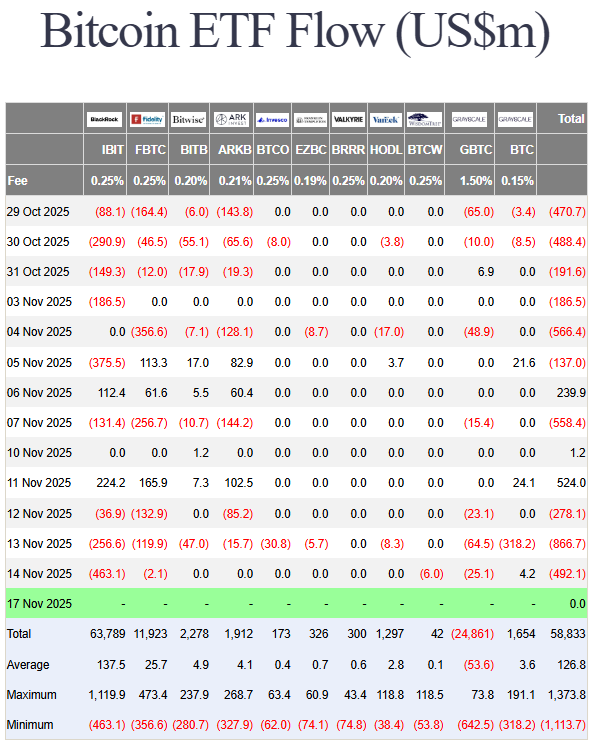

- Spot Bitcoin ETFs pulled $1.1B in five days, triggering a tense phase marked by a 10% price drop and institutional flows that continue to lose strength.

- Matrixport sees the start of a “mini” bear market driven by reduced exposure among long-time investors and a macro environment with no clear catalysts.

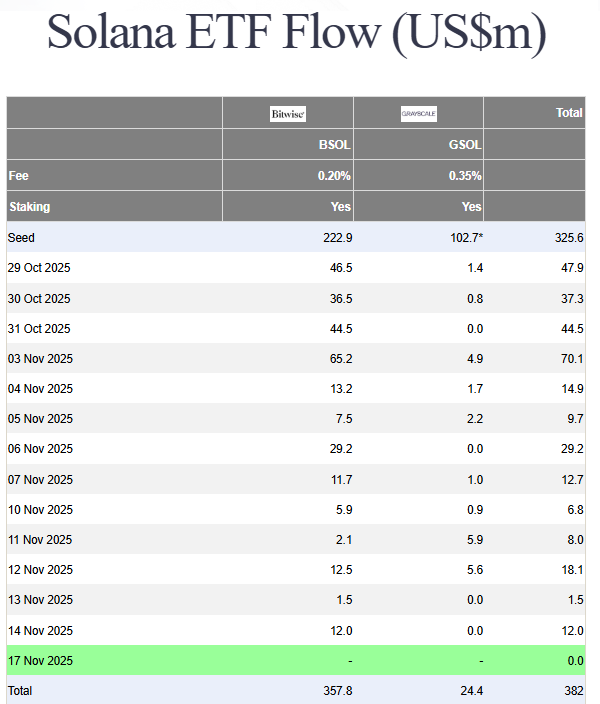

- Solana ETFs added $12M after 13 consecutive days of inflows, while Ethereum ETFs lost $177M over four days.

Bitcoin has entered a tense phase shaped by weak technical signals, macro pressure, and a visible deterioration in institutional flows.

US spot ETFs closed their third straight week in outflows, removing $1.1B in just five days, a volume that points to a shift in whale appetite. The loss of momentum came alongside a nearly 10% decline in Bitcoin’s price, which returned to the $95,700 area and confirmed that the market has left behind the expansionary pattern of recent weeks.

Bitcoin Finds No Catalyst for a Recovery

Matrixport characterizes this moment as the opening stretch of a “mini” bear market. The firm argues that the market has lost its ability to react to fresh inflows and that long-time holders have been gradually reducing exposure.

That dynamic is intensifying because macro variables aren’t offering clear signals and derivatives traders are repositioning toward lower-risk ranges. The result is a setup that depends almost entirely on the Federal Reserve’s next decisions and on technical levels that now act as psychological anchors.

The pullback also exposed the fragility of flows in a market that expanded through 2025 thanks to two engines: spot ETFs and corporate purchases led by Strategy. The loss of traction in those channels leaves the market in a place where any macro surprise could dictate the next few weeks. Matrixport describes this stage as a “pivotal juncture,” where Bitcoin needs to hold key support zones to avoid added pressure from institutional managers.

Solana Falls Despite Strong ETF Demand

Bitcoin’s performance stands in sharp contrast to Solana. Its ETFs recorded 13 consecutive days of inflows and added $12M on Friday, a notable run in a market dominated by outflows. Even so, SOL fell 15% on the week because ETF demand still isn’t large enough to offset the broader market correction. Ethereum, meanwhile, shows the opposite pattern: its ETFs logged four straight days of outflows and lost $177M on Friday, matching an 11% weekly decline.

The market now operates in a fragile balance. Outflows continue, prices retreat, and institutional activity is becoming more selective, with a clear preference for assets that maintain their own adoption cycles. The next signal from the Federal Reserve will determine whether this phase stabilizes or the pressure intensifies.