TL;DR

- Bitcoin has reached a new technical high of $66,000, marking a significant change in its recovery, supported by record on-chain metrics.

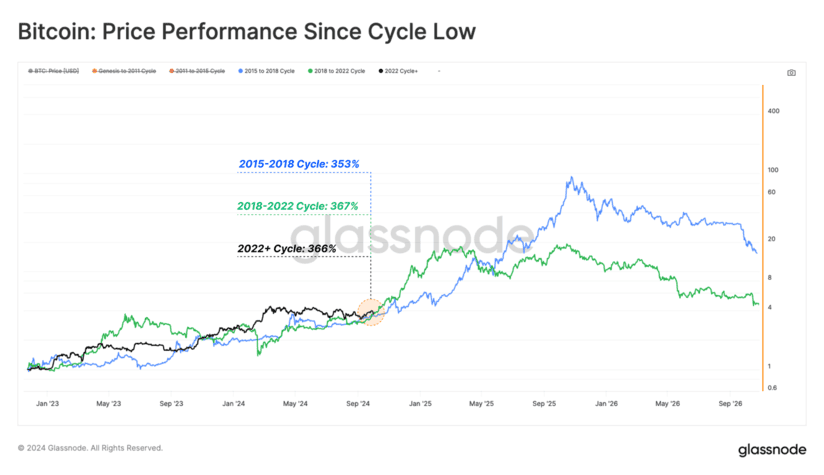

- The similarities in BTC’s performance with previous cycles suggest a comparable pattern, despite differing market conditions.

- The profitability of short-term holders has improved, and 47.4% of the BTC in loss belongs to long-term holders, although their losses are modest.

The Bitcoin market has recorded an important shift, establishing a new technical high by reaching the $66,000 zone. This is key for the recovery of the digital asset, being the first time since its all-time high that a higher level has been achieved. The increase has been supported by a set of on-chain metrics that have also reached record levels, making this period one of particular interest for analysts in the sector.

When evaluating Bitcoin’s price performance since the low of the bear cycle, surprising similarities emerge with previous cycles. Despite significantly different market conditions in each cycle, BTC’s trajectory has followed a comparable pattern.

This situation results from a series of factors that may be influencing the market’s direction. On one hand, there has been an increase in the number of long-term holder coins that are in loss, especially those purchased near the $73,000 all-time high. However, the magnitude of these losses is relatively low, indicating that the financial pressure on these investors is not particularly relevant.

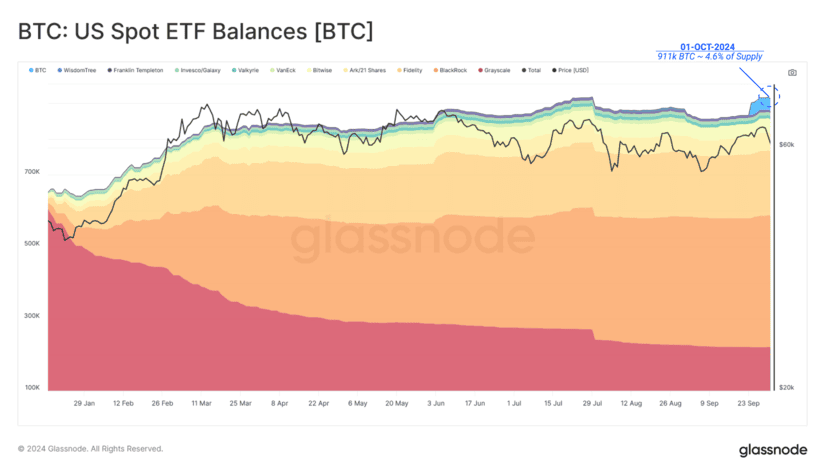

The Fundamental Role of ETFs

Additionally, the profitability of short-term holders has shown a clear improvement during the recent rally, providing relief for those who acquired BTC in the short term. The increase in the profitability of new investors indicates a reintegration of confidence in the market, even though many of them are still in a loss position relative to their entry costs.

The conviction of investors in Bitcoin exchange-traded funds (ETFs) has also remained high. Despite ETFs being in an average loss position, selling pressure has been minimal. Currently, assets under management in U.S. BTC ETFs reach a value of approximately $58 billion, representing about 4.6% of the circulating BTC supply. This strong institutional interest is crucial for reinforcing market stability and provides a solid foundation for future growth.

Bitcoin is Aimed at Recovery

The analysis of Bitcoin’s supply also reveals a change in the dynamics between long-term and short-term holders. Currently, 47.4% of the BTC in loss belongs to long-term holders, but the size of their losses is modest, meaning they are less financially pressured. This trend is also reflected in the increase of supply among short-term holders, where more than 62% of the coins are in a profitable position.

The Bitcoin rally has not only led the asset to a new technical high but has also improved investor profitability and reduced overall financial pressure. With a solid institutional base and a pattern of holder behavior showing signs of accumulation, the future of Bitcoin seems to be oriented towards a continuous and sustainable recovery in the market