TL;DR

- Bitcoin Cash (BCH) open interest (OI) decreased by 47% from its pre-halving peak, reaching $378.3 million on April 12, coinciding with a 13% decline in BCH price.

- The cryptocurrency experienced a sharp 7.51% drop on April 10 within a three-hour period, following days of narrow price fluctuations between $676 and $691.

- The current situation contrasts with the 2020 BCH halving, where BCH saw a 4.7% price increase and a 10% rise in open interest shortly after the event.

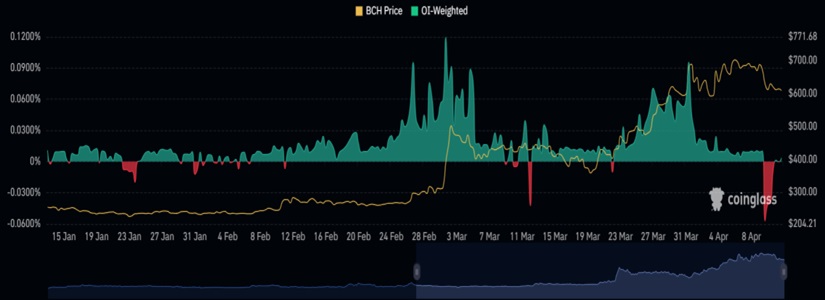

According to CoinGlass data, Bitcoin Cash (BCH) open interest (OI) decreased significantly by 47% from its pre-halving peak, settling at $378.3 million on April 12. This coincided with a 13% decline in BCH price during the same period, raising concerns among much of the community.

On April 10, the cryptocurrency experienced a 7.51% drop within just three hours. This abrupt decline followed several days of tight price fluctuations between $676 and $691. Such volatile movements have drawn attention to the uncertainty in the Bitcoin Cash market, affecting both investors and traders.

The current situation stands in stark contrast to the 2020 BCH halving, where the cryptocurrency witnessed a 4.7% price increase and a 10% surge in open interest shortly after the event, highlighting the unpredictable nature of the crypto market.

Conflict Between Bitcoin Communities

In this context, tensions between BTC and BCH communities have resurfaced. Blockstream CEO, Adam Back, recently urged Roger Ver, also known as “Bitcoin Jesus,” to return to the Bitcoin community after previously joining the Bitcoin Cash community.

On the other hand, Ver staunchly defends BCH as a superior alternative to BTC, arguing that BCH aligns more closely with Satoshi Nakamoto’s original vision and has the potential to serve as both a store of value and a daily-use currency due to its lower transaction fees.

Bitcoin is at a critical juncture. While BCH faces headwinds and conflicts arise between communities, the BTC halving looms ahead, leaving analysts and experts uncertain about its impact on BTC.