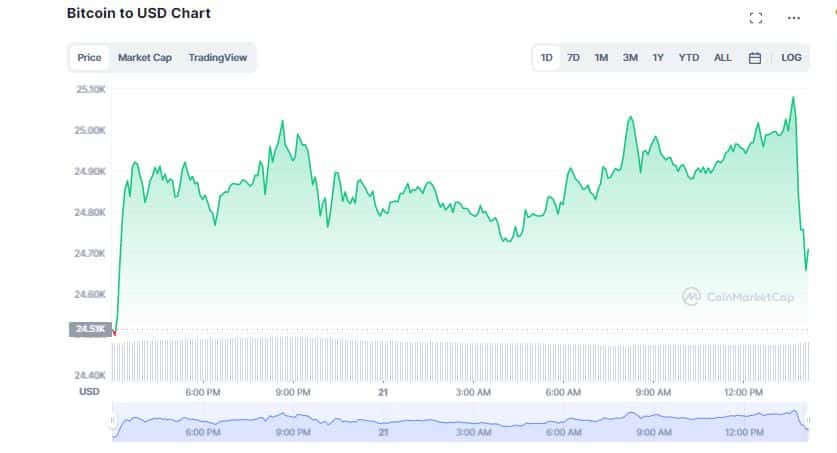

The cryptocurrency market was trading higher as Bitcoin (BTC) crossed the $25K mark over the past day. Experts believe major indicators continue to point to a “neutral sentiment” in the current market ahead of the release of the Federal Open Market Committee (FOMC) minutes on Wednesday.

According to CoinMarketCap, the global crypto market cap climbed 1.29% in the last 24 hours to $1.13 trillion. However, Ethereum (ETH) along with major altcoins experienced a marginal fall over the past 24 hours as the digital assets market continue to fluctuate.

It seems, investors are keeping a close eye on the upcoming FOMC meeting minutes, which are set to be released tomorrow. In a statement, Sathvik Vishwanath, CEO at Unocoin said,

“The release of the FOMC minutes on Wednesday could affect the price of cryptocurrency, as any hint of a shift in US monetary policy can affect financial markets.”

Bitcoin Fluctuates Ahead of FOMC Meeting

Although, Bitcoin (BTC) crossed above $25K, the digital token observed a slight decline, slipping to $24,714. However, the flagship token is still up 0.96% in the last 24 hours with BTC recording a gain of more than 13% over the past seven day.

As per several experts, the downward trend may be linked to the recent economic data suggesting that the Federal Reserve will continue with its plan to tighten monetary policy for a longer period than previously expected. It is believed the Fed may follow a steeper rise in rates than previously thought. Vishwanath added,

“Bitcoin technical indicators such as RSI and MACD are showing divergence, indicating uncertainty among investors. If the price breaks below the $23,750 support level, the next support level is $22,850.”

The Fed Minutes May Reveal A Steep Rise In Rates On The Horizon https://t.co/HD6Y3prR2p $spx $spy $qqq $tlt #rates #inflation #fed #minutes #fomc #stocks #markets #stockmarket #trading

— Michael J. Kramer (@MichaelMOTTCM) February 19, 2023

BTC Delivers Technical Bullish Momentum

Despite the slight fall, Bitcoin has delivered an important technical bullish signal that it has not seen in over a year. BTC Guppy, a technical analysis tool, has flipped for the first time in over 12 months signalling the cryptocurrency may be poised for a significant price surge.

The #BTC Guppy has flipped for the first time in over a year.

The shorter-term moving averages (blue) have flipped the longer-term moving averages (red) for the first time in over 12 months. pic.twitter.com/mXU7aGyn3G

— Delphi Digital (@Delphi_Digital) February 20, 2023

On February 20, Delphi Digital took to Twitter to reveal Bitcoin’s recent flip of the Guppy could be a strong indicator of a bullish trend. The crypto research platform added the shorter-term moving averages have flipped the longer-term moving averages for the first time in over 12 months. In a nutshell, when the shorter-term moving averages cross above the longer-term moving averages, it is considered a bullish signal.