The cryptocurrency market continues to bleed, trading lower on Tuesday ahead of the US Federal Reserve’s monetary policy decision tomorrow.

Bitcoin (BTC) and the rest of the digital assets market saw significant gains after Ripple (XRP) secured a partial victory against the United States Securities and Exchange Commission (SEC) on July 13. However, the market has been on a downward trend since the past weekend, owing to several factors.

Macroeconomic Factors Batter Crypto Space

Recently, the SEC has hinted it may be set to appeal a recent ruling against the agency in its case against Ripple Labs and the XRP token. This might have dampened the enthusiasm that had triggered a brief rally in the crypto market. Moreover, the U.S. Federal Reserve, Bank of Japan and European Central Bank (ECB) will all announce key interest rate decisions this week, impacting the new asset class.

As per reports, the Federal Open Market Committee (FOMC) is expected to raise interest rates by 25 basis points this week with an expectation that this may be the last rate hike by the Federal Reserve in the foreseeable future. Echoing the same tune, the ECB is also likely to continue to increase rates in July.

Both Fed Chair Jerome Powell and ECB President Christine Lagarde have warned that inflation remains too high, forcing them to raise borrowing costs further. However, The Bank of Japan remains the outlier, with more than 80% of analysts polled expecting Governor Kazuo Ueda to continue pumping support into the world’s No. 3 economy even as inflation remains above their 2% target.

Bitcoin Swims in Red

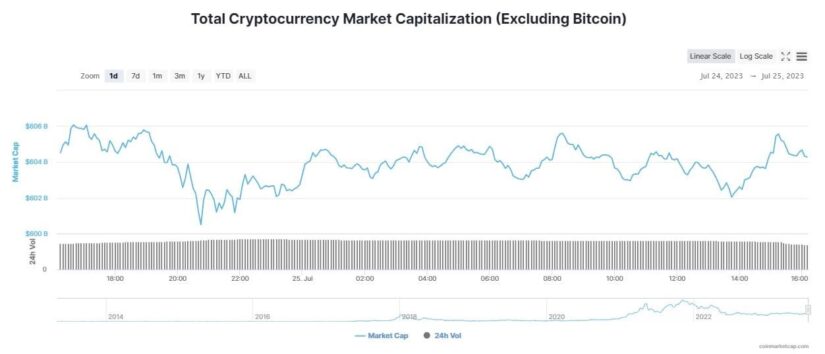

These factors have pushed the total crypto market cap down almost $40 billion in a day. According to CoinMarketCap, the global cryptocurrency market cap was trading lower, around $1.17 trillion, falling 1.65% in the last 24 hours. Whereas, Bitcoin (BTC) plunged 1.86% to trade at $29,176.

Over the past seven days, the largest digital asset fell 2.77% after registering its most impressive price surge two weeks ago when Ripple cliched a partial victory in court against the SEC. Bitcoin’s dominance over the last 24 hours also declined from 0.13% to 48.44%.

Bitcoin (BTC) volatility has also dipped to its lowest level in a year as investors await the FOMC meeting tomorrow. The 30-day estimate for BTC volatility has fallen to just 0.74%, which is the lowest level since January 16, 2023. As per experts, BTC needs to hold $28,500 in case of a further fall to regain lost value.

Altcoins Plunge Deeper

Its largest peer, Ethereum (ETH) slipped 0.79% in the last 24 hours to trade at $1,855. Meanwhile, the second-largest digital token tanked 2.49% over the past week. Furthermore, other crypto tokens also continued their downward movement on Tuesday.

XRP plummeted more than 4% in the last 24 hours to trade at $0.68. In tandem with the broader crypto market, Cardano (ADA) and Polygon (MATIC) shrank over 2%, each. Solana (SOL) spiraled downwards by more than 5% in the past 24 hours.

Despite Market Turbulence DOGE Gathers Steam

Despite falling prices, Dogecoin (DOGE) the largest meme coin in the crypto ecosystem, is experiencing an increase in price and in other on-chain metrics such as social media dominance in light of Twitter’s rebranding to X.

Over the past 24 hours, the dog-themed cryptocurrency jumped 3,03% to hover at $0.076. It is likely the meme coin’s price rally was fueled by billionaire Elon Musk’s interest in DOGE, speculation of DOGE tokens being used as payments on the app, and bullish on-chain metrics.