In the world of cryptocurrency, Bitcoin is the most disruptive and widely used digital currency, with the ability to break down doors at an alarming rate. This coin has experienced an exponential rise in the last few years, so there is no doubt that thousands of altcoins and crypto projects have been able to carve out a place for themselves.

There is no doubt that Bitcoin has long been regarded as the ‘best’ cryptocurrency for many years, but in recent years other cryptocurrencies have emerged.

Although Bitcoin is volatile like other coins, there are still many investors who look at it as a potential investment because of its high-value potential.

Essentially, Bitcoin is not a centrally controlled digital currency, but rather it is a peer-to-peer (P2P) currency that uses blockchain technology to verify transactions between users. The technology is widely used in the current cryptocurrency market, but back when Bitcoin was first released in 2009, many industries had no idea what to make of the concept.

As we discuss the price of bitcoin in this guide, we will include a short-term and long-term forecast, as well as discuss the coin’s potential and the factors that influence its price.

Bitcoin (BTC) Price Prediction 2023-2025-2030

BTC was first valued at $0.0008 when it began trading in July 2010, which is the first time the price has ever been recorded. Bitcoin was one of the most popular cryptocurrencies over the next few years, as investors looking to gain exposure to this new technology drove the BTC price through the following years, reaching $250 in 2013 as a result. The entry of Bitcoin into the mainstream market did not occur until mid-2017, however.

Through the second half of 2017, Bitcoin’s price rose by a staggering 2,300%, breaking the $19,000 mark for the first time since its inception. Approximately 85% of Bitcoin’s value was lost during the bear market that followed this high, which was a sustained bear market. During the course of this time frame, there were a few bullish spikes dotted around, but the real movement began by the end of the decade.

Bitcoin increased in value by over 540% from September 2020 to April 2021, reaching a high of over $64,700 at one point in time. The price of bitcoin has surged once again, reaching an all-time high of $68,789, according to CoinMarketCap, after a short pullback after it surged once again.

Due to the fallout from the collapse of FTX in 2022, the price of bitcoin has been heavily affected. However, despite the fact that BTC didn’t directly participate in the failure, the contagion effect from the failure has led to many investors liquidating their crypto holdings as a result of the failure. Sadly, the effect of this has been to cause the price of Bitcoin to fall, which has resulted in a loss for investors.

In the years 2023, 2025, and 2030 we will be able to see what might happen to the coin.

Bitcoin (BTC) Price Prediction 2023

In terms of technical analysis, we can estimate that by 2023, the lowest Bitcoin price expected in the world will be about $12K, based on the technical analysis. BTC’s price can reach a maximum of $38.

Price Prediction Websites

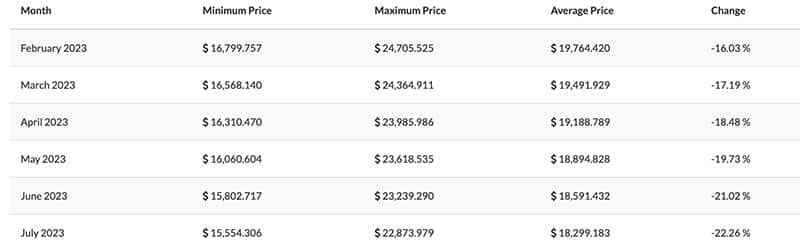

A report by Tradingbeasts states that Bitcoin prices are predicted to reach $18,591.432 by the beginning of the month of July 2023, based on an analysis of the data. There is a potential price of $23,239.290 and a minimum price of $15,802.717. In the end, the price of bitcoin is predicted to be $18,591.432 at the end of the month.

According to PricePrediction, the price of Bitcoin is expected to cross a price level of $35,405.96 by the end of 2023, and with the current year coming to an end, the price value of Bitcoin should be at a minimum of $34,486.35. The price of Bitcoin is also expected to reach a maximum price level of $38,660.40 by the end of 2023.

Twitter Experts and Influencers Predictions

According to Rohit, if Bitcoin can start the run toward the previous ATH in 2023, then it has an enormous amount of potential for the future. By the year 2023, he predicts that the coin will reach a value of roughly $31K.

My 2023 price predictions:#BTC $30,628#ETH $2,258

— Keyur Rohit (@CryptoKingKeyur) January 27, 2023

Prediction and Forecast Youtube Channels

It has been said that Bitcoin is expected to start an uptrend in 2023 according to a short video analysis from TheKaleShow. He believes that Bitcoin will reach $30K or even $40K in 2023, despite the fact that many analysts believe BTC will go down to $10K by then.

This video below from ClearValue Tax features an analyst who believes that a bull run in the crypto market may begin as early as 2024. Although he does not expect the bull run to begin until 2024, he has a bearish outlook on BTC for 2023.

This video reviews a number of factors that will have an impact on the price of Bitcoin in 2023. Among them are a lower interest rate environment and a pivot by the Federal Reserve.

According to the analyst, it is possible that the coin can be traded for $12K or even lower at some point in the future. Also, if that were to happen, altcoins would be hit much harder.

The best price predictions for Bitcoin (BTC) in 2023

We believe that the highest price that can be expected for Bitcoin from our sources is around $38K. It is generally agreed that the bull run cannot start in 2023, and there isn’t going to be a new ATH for bitcoin in that year.

The worst price predictions for Bitcoin (BTC) in 2023

Based on the information we have collected from our sources, the lowest Bitcoin price prediction comes from a video that depicts a continued bear market before the bull market reaches its apex in 2024. As a result of this, the source claims that Bitcoin could drop as low as $12K by 2023.

Bitcoin (BTC) Price Forecast 2025

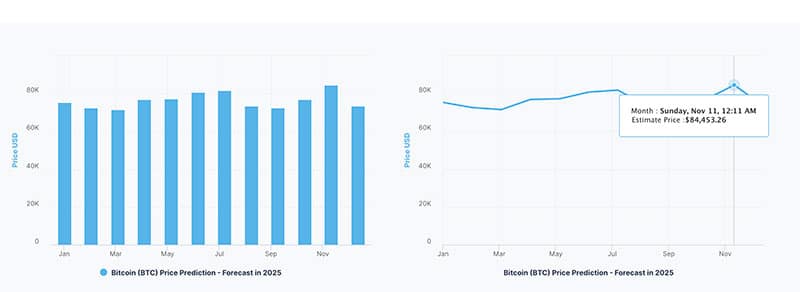

Several cryptocurrency experts have recently analyzed the technical aspects of Bitcoin in order to help predict the future price of Bitcoin in the year 2025. Based on their analysis, Bitcoin is expected to reach a minimum price of $49K, and a maximum price of $270K in the year 2025.

Price Prediction Websites

It is expected that the price of Bitcoin will exceed a threshold of $71,713.54 (according to DigitalcoinPrice), and by the end of the year, Bitcoin is expected to reach a minimum fee of $68,512.52. In addition, the BTC price is capable of getting a maximum level of $73,284.09.

There are a few ways to forecast where Bitcoin price could go over the long term on CoinCodex by comparing it against the price of other important technological developments and trends.

If Bitcoin prices follow the growth of Facebook in the next years, then the best-case scenario is that the price of the currency will be $ 254,687 in the year 2025. According to our prediction, Bitcoin will be worth $ 48,942 in 2025 if it follows Mobile growth.

Twitter Experts and Influencers Predictions

There have been reports that BTC may reach the $100K target by the year 2025, according to a tweet from Telcoin_NFT. As a result of the halving, which is predicted to happen in 2024, the bull market is predicted to emerge.

Bullish on #Bitcoin price:

– November 2022 low of $15,5K was the bottom

– BTC has crossed Short Term Holder (STH) and will rise into 2024-halving and subsequent 2025 bull market. Several on-chain signals confirm STH signal.

– 2024 halving will be >$32K

– 2025 bull market >$100K pic.twitter.com/CfmM2UV6sZ— Telcoin_NFT (@telcoin_nft) January 24, 2023

Stacks predicts that Bitcoin’s price line will follow a similar curve in 2025 based on her research. According to her, the coin will reach a price of $40K before halving, which might happen in 2024, if things go according to plan. There is a possibility that BTC will reach a price of six figures at some point in the future.

https://twitter.com/bison_bitcoin/status/1616471477901004807

Prediction and Forecast Youtube Channels

There is some evidence that Bitcoin can pass the last ATH in 2025, based on a video released by the Crypto University channel. There is a belief that by the end of the year, the price of Bitcoin could reach $80K.

The Bitcoin price prediction for 2025 by Thomas Kralow is available in a video. In this episode, he discusses a number of fundamental factors and technical factors that play a role in price movement. In his opinion, the price of Bitcoin will be affected by the next halving that occurs in 2024.

It is possible that the price may go up 1000% after the price is halved. In 2025, it will result in Bitcoin being traded at an approximate price of $270K, which is extremely high.

The best price predictions for Bitcoin (BTC) in 2025

As you can see in the video above, the highest Bitcoin price prediction for 2025 has been made. According to the source, Bitcoin is expected to reach $270K in 2025, which may seem a little unrealistic at first glance. However, don’t forget that at first glance, most of the ATHs we saw in the BTC chart seemed completely unrealistic.

The worst price predictions for Bitcoin (BTC) in 2025

In comparison to our other sources of information, Coincodex has one of the lowest predictions for Bitcoin. It has been predicted that Bitcoin’s price will reach $49K by the end of that year if it follows the mobile growth in that year as predicted by this website, which is a very low price compared to the highest price predicted.

Bitcoin (BTC) Price Prediction 2030

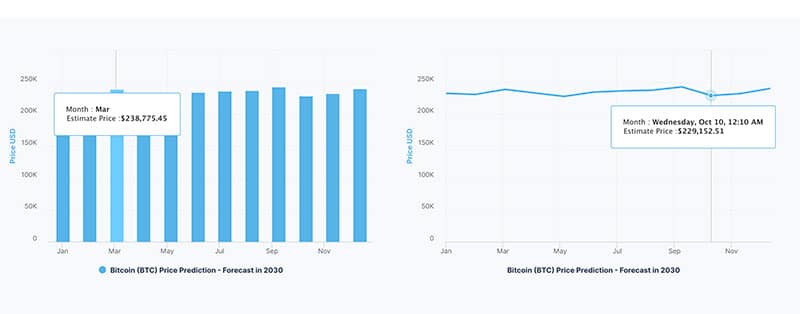

Bitcoin’s price is going to be forecasted by cryptocurrency analysts in the coming years. It is estimated that the BTC price will reach $4.6M by the end of 2030. In other words, a trading price of $226K would be the expected low price for this coin.

Price Prediction Websites

According to PricePrediction, Bitcoin price is expected to reach a maximum price level of $567,926.15 by the end of 2030. By 2030, the Bitcoin price is expected to cross an average price level of $483,953.21, while the Bitcoin price by the end of the current year should be $466,971.89. Bitcoin price is also likely to reach a maximum value of $567,926.15 by 2030.

According to the data published by DigitalCoinPrice, Bitcoin’s price is expected to cross a price level of $239,392.44 by the end of the year, Bitcoin is expected to reach a minimum fee of $225,957.22. In addition, the BTC price is capable of getting a maximum level of $240,283.31.

Prediction and Forecast Youtube Channels

According to a video on the WatchAnswers channel, Metcalfe’s law is used in predicting Bitcoin’s price in 2030. Throughout the video, you will see a variety of scenarios.

It is possible that Bitcoin can trade at $733,044 at the beginning of that year if we consider the bear scenario in the video. But if you look at the expected and bull scenario, it is much higher, at around $1,190,039 and $4,625,379 which is way too optimistic for us.

In a video published by Andrei Jikh, he focuses on the $1M prediction a lot of people talk about when it comes to predicting the price of Bitcoin in 2030. When analyzing the price of an asset, he believes that the market cap factor is a very important one to consider.

According to the analysts, many factors play a role in the economic settlement network, including the remittance market. Even if Bitcoin reaches $1M by 2030, it is still possible for it to rise to that level.

The best price predictions for Bitcoin (BTC) in 2030

Bitcoin is expected to reach a million-dollar mark by 2030, according to many analysts. In support of this prediction, there are a number of different scenarios that can be considered.

According to the InvestAnswers youtube channel, the best prediction is that Bitcoin will be traded at $4.6M by 2030, which is the highest price in our sources.

The worst price predictions for Bitcoin (BTC) in 2030

BTC is expected to reach a price of six figures at its lowest point in 2030. BTC is estimated to be worth about $226K according to the analysts at DigitalCoinPrice.

Could Bitcoin (BTC) be worth 1 million dollars?

Some people believe that Bitcoin is going to rise to a minimum of one million dollars over the long term, thus becoming the world’s reserve currency in the future. It has been claimed that a Bitcoin could reach a price of $1 million by 2030.

As well as this, Bitcoin mining encourages and enables the use of renewable carbon-friendly electricity derived from renewable sources. There will, however, be a slow but steady increase in institutional investors purchasing or selling Bitcoin in the future.

There is also a competitor for this digital asset in the form of traditional gold and one based on digital gold. It is also estimated that the private sector has a gold value of about $2.7 trillion for investments. Bitcoin will have to reach just over $146,000 in order to reach a market capitalization of $2.7 trillion, according to CoinMarketCap.

There are, however, some cautions that should be kept in mind when using this virtual currency, the most significant of which is the volatility of its price. It is known that this cryptocurrency has wild price swings due to its volatile nature.

The other way of putting it is that Bitcoin is more volatile than gold. To ensure that Bitcoin’s volatility will converge with gold in the near future, institutional adoption is crucial. Therefore, as a result of institutional adoption taking place at a faster pace, the possible volatility of merging is going to be greater as well.

Conclusion

In order to decide whether Bitcoin is a good investment or not, you should consider your portfolio as well as your appetite for risk. There is still a lot of momentum behind the crypto market and despite all the doom and gloom posts posted online by a variety of experts in the stock market, the crypto bubble still hasn’t popped. It is true that Bitcoin can indeed be a good investment if it fits into your portfolio and if you fully believe in it as an asset.

Bitcoin has been characterized by extreme price volatility throughout its very short history as an investment product. As with any investment, it will be determined by a number of factors, including your financial situation, investment portfolio, risk tolerance, and investment objectives.

As a result, you should always consult a financial expert before investing in cryptocurrencies to ensure that it is appropriate for your situation before you make a decision.

The Price Predictions published in this article are based on estimates made by industry professionals, they are not investment recommendations, and it should be understood that these predictions may not occur as described.

The content of this article should only be taken as a guide, and you should always carry out your own analysis before making any investment.