Latest Bitcoin [BTC] News

There are perhaps myriads of reasons as to why the SEC is reluctant to give the green lights to Bitcoin ETF. Ranging from unsatisfactory monitoring tools, general manipulation—allegedly caused by well-orchestrated pumps and dumps, together with insufficient custody features, Jay Clayton and the commission is on the edge.

However, what is unsettling for the ordinary investor are prevalent cryptocurrency heists. It has been lining up well in the past few months. Quadriga CX was the most visibility because Cotten, for some unexplained reason died with the exchange’s cold wallets private keys.

Good news is, authorities collaborating across different jurisdiction are recording encouraging breakthroughs. As more private firms venture into lucrative blockchain analysis, firms like Chainanalysis are of help, the arrests in Israel of overly massive for BitFinex and for victims.

Making away with 120,000 BTCs after successfully cloning sites of popular exchanges and wallet providers, the two conniving brothers, Eli and Assaf Gigi were arrested in Israel. Although not much of the original stash could be retrieved, it is a significant for the entire blockchain community.

Perhaps to celebrate, BitFinex announced a new margin trading feature of up-to 100X of the initial investment. Risky as it is-especially when combined with fragile and volatile nature of BTC markets, traders can now punt more from loaned funds.

BTC/USD Price Analysis

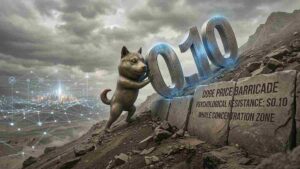

At the time of writing, BTC prices are calm. Recovering after unexpected meltdown from close of last month, prices are stable but under pressure in the last day. All the same, even though buyers have a chance to build on the momentum of the superb gains of March through to June, there is a possibility that prices will cave lower in days ahead.

Note that main support is at $9,500 and leading this trade plan is the double bar bear reversal pattern of June 26-27. Conspicuous in that June 27 bear bar was wide-ranging, sellers were temporarily pumped.

Despite the correction and recovery from $9,500, the confirmation of June 27 bear bar on June 30 is heaping pressure on bulls. As such, for trend continuation it is vital that prices rally past $14,000. Behind that revival must be high trading volumes preferably exceeding 82k of June 26.

If not and there is a flash drop below $10,000 and $9,500 in confirmation of June 26-27 losses, odds are BTC will drop to $7,500 in a retest. On the flip side, any upswing above $14,000 with high level of participation could see BTC rally to $15,000 and $18,000 in coming weeks.

Chart courtesy of TradingView—Coinbase

Disclaimer: Views and opinions expressed are those of the author and aren’t investment advice. Trading of any form involves risk and so do your due diligence before making a trading decision.

![Bitcoin [BTC] Daily Chart-July 5](https://crypto-economy.com/wp-content/uploads/2022/12/Bitcoin-Daily-Chart-July-5.png)