Bitcoin (BTC) witnessed a sharp fall of nearly 5% in the last 24 hours as the broader crypto market lost more than $60 billion over the past hour. The downturn comes amid mounting pressure after leading crypto bank, Silvergate Capital, told the U.S. Securities and Exchange Commission that it won’t be able to file its annual report on time and that it is evaluating its ability to stay in business.

The cryptocurrency market shivered after Silvergate’s latest filing raising questions about the company’s ability to stay in business. This comes on the heels after the crypto bank reported losses for the fourth quarter of 2022 totaling more than a staggering $1 billion. Last month, the company also slashed almost 40% of its workforce citing “the economic realities facing the digital asset industry today.”

Shares of Silvergate Capital plummeted almost 67% year-to-date (YTD) on Thursday after the bank delayed the filing of its annual report. As per the latest filing, the bank also hinted at further regulatory scrutiny ahead which it said could hit its profitability.

Bitcoin Slips Below $23K

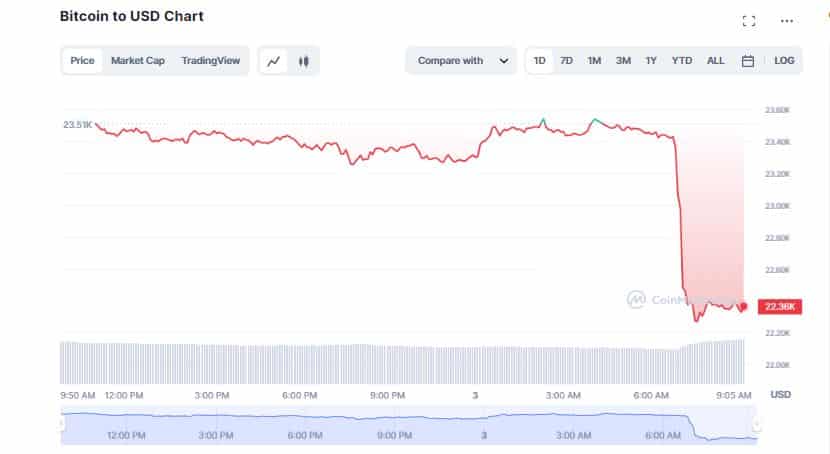

The development has caused another round of battering for the digital assets sector. According to CoinMarketCap, Bitcoin (BTC) took a dive below the psychological level of $23.500 plunging 4.84% in the last 24 hours to currently hover at $22,375.

The flagship crypto dropped more than 6% over the past seven days as Silvergate shares shrank to a record low as key partners including Coinbase Global Inc., Galaxy Digital and Paxos Trust Co. announced that they will no longer accept or initiate payments through Silvergate. Bitcoin’s dominance fell 0.12% over the day to 42.19%. In a statement, Markus Thielen, the head of research at digital asset platform Matrixport, said,

“The drop is due to the continuous fallout from Silvergate bank as there is now more uncertainty about fiat on-and-off ramp. In addition, there are now wider industry concerns that US regulators are trying to cut off further banking relationships between crypto firms and FDIC insured banks.”

1/2 In light of recent developments, Galaxy has stopped accepting or initiating transfers to Silvergate. As a firm, we continue to have no material exposure to Silvergate, and this action was taken out of an abundance of caution.

— Galaxy (@galaxyhq) March 2, 2023

Crypto Markets Lose $60 Billion in 1 Hour

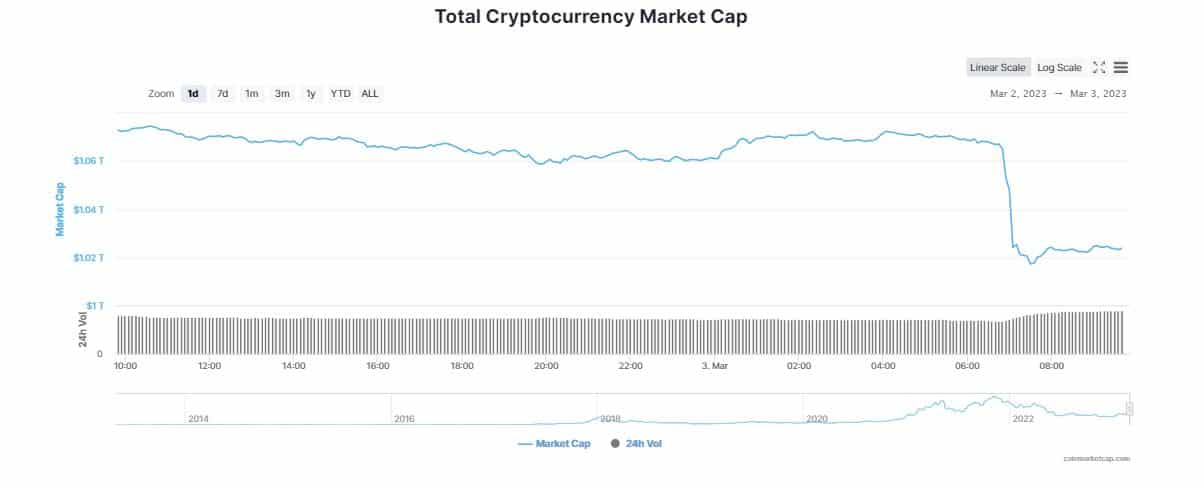

At the same time, the global crypto market cap slipped 4.56% in the last 24 hours to $1.02 trillion. It is worth noting that total market capitalization shrunk by more than $60 billion over the past hour, hitting mid-February lows, which served as support at current levels.

In tandem with the broader crypto market, Ethereum (ETH) declined more than 5% in the past 24 hours to $1,565. Ether tumbled nearly 5.11% over the past one week falling from the crucial $1,600 mark. Meanwhile, the massive sell off in the market put immense pressure on most of the altcoins. Cardano (ADA) and Litecoin (LTC) plummeted 7.19% and 8.13% in the last 24 hours, respectively.

In the same time frame, Polkadot (DOT), Polygon (MATIC) and Solana (SOL) dropped in the range between 5.12% and 5.38%. XRP declined more than 3% to trade at $0.36. Popular memecoins such as Dogecoin (DOGE) and Shiba Inu (SHIB) lost 7.22% and 6.32% over the past 24 hours. It seems the U.S.-based cryptocurrency bank Silvergate Capital Corp. could be the next corporate victim of the Sam Bankman-Fried’s FTX crash.