TL;DR

- Bitcoin and Ethereum ETFs recorded a combined $448 million in net inflows, driven by renewed institutional demand and improving crypto market sentiment.

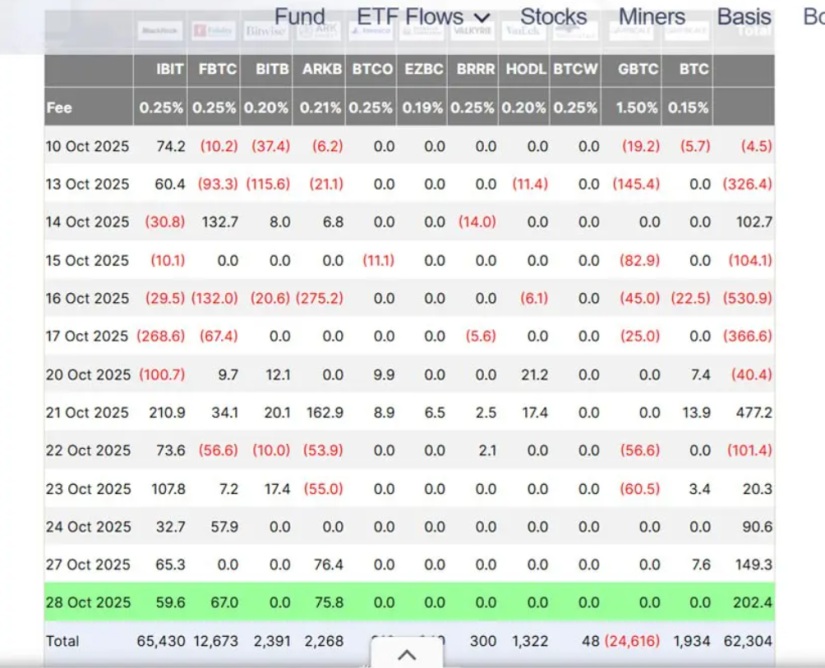

- BTC funds added $202 million over four consecutive days of inflows, while Ethereum ETFs attracted $246 million.

- The stabilization of staking yields and the expansion of Layer-2 networks continue to support institutional confidence in Ethereum.

Bitcoin and Ethereum ETFs posted net inflows as institutional demand rebounded and overall sentiment in the crypto market improved.

Bitcoin ETFs recorded $202 million in inflows across four consecutive sessions, while Ethereum ETFs accumulated $246 million, reversing two weeks of sustained outflows that had totaled nearly $550 million.

Ethereum’s rebound indicates that institutional investors have regained confidence in assets linked to the network. Ethereum ETFs now hold $27.66 billion in total net assets, with cumulative inflows of $14.73 billion, equivalent to 5.76% of the total ETH supply.

Staking and L2 Networks Are Key to Ethereum’s Momentum

Among the top-performing funds, the Fidelity Ethereum Fund (FETH) led with $99.3 million in inflows, followed by BlackRock’s iShares Ethereum Trust with $76.3 million and Grayscale’s ETHE with $73 million. The stabilization of staking yields and rising activity across Layer-2 networks have been crucial in sustaining institutional confidence in Ethereum.

Bitcoin ETFs remain on an upward trend. The recent accumulation has pushed total spot ETF inflows to $62.34 billion, with total net assets reaching $154.81 billion, representing 6.88% of Bitcoin’s circulating supply.

BlackRock Continues to Dominate the Bitcoin ETF Market

Funds such as ARKB (Ark & 21Shares Bitcoin Trust) and FBTC (Fidelity Wise Origin Bitcoin Fund) contributed $75.84 million and $67.05 million, respectively, while BlackRock’s iShares Bitcoin Trust (IBIT) posted $59.6 million over six consecutive days, totaling $448 million in that period. This institutional accumulation confirms a rotation of capital toward on-chain assets, reinforcing BTC’s position as a store of value within the crypto ecosystem.

The surge in ETF inflows must be viewed within a broader macro context: expectations of monetary easing ahead of the FOMC meeting and a general increase in market risk appetite are key factors.

BTC is trading near $113,110, down 1.2% on the day, while Ethereum holds around $4,000, down 2.8% over the past 24 hours. Despite short-term volatility, institutional interest and liquidity continue to expand