TL;DR

- The collapse in the difference between the perpetual funding rates of Bitcoin and Ether signals an increase in risk appetite in the crypto market.

- This indicates a greater willingness of investors to take risks by channeling funds into smaller and riskier altcoins.

- A positive funding rate indicates a bullish bias, while a negative rate suggests the opposite.

The collapse in the difference between the perpetual funding rates of Bitcoin and Ether has caught the attention of crypto investors worldwide. This phenomenon signals an increase in risk appetite in the market, especially among those interested in alternative coins or altcoins.

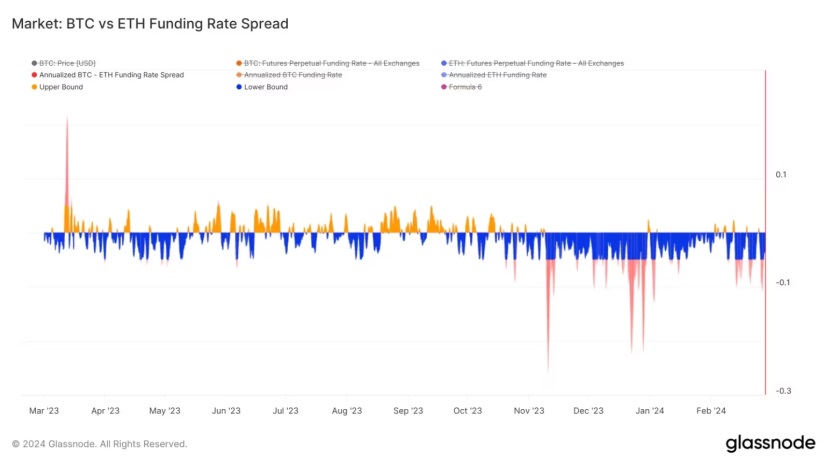

The difference in perpetual funding rates, tracked by Glassnode, recently fell to an annualized level of -9%. This indicates that investors are willing to pay more to take leveraged long or bullish positions in the perpetual futures market of Ether compared to Bitcoin (BTC). In other words, there is a greater willingness to take risks: investors are channeling funds into smaller and riskier altcoins, anticipating significant gains.

Glassnode noted that, before October 2023, a relatively neutral regime was observed where the difference between the funding rates of BTC and ETH oscillated between positive and negative states. However, since the October rally, funding rates for ETH have consistently been higher than for BTC, suggesting an increase in traders’ propensity to speculate beyond conventional risk.

The Gap in Rates Between Bitcoin and Ethereum Reflects Risk Sentiment

Bitcoin, as the largest cryptocurrency by market capitalization and the most liquid, contrasts with Ether, considered a leading and relatively volatile altcoin. Therefore, the difference in funding rates between them reflects the overall risk sentiment in the market, similar to how AUD/JPY currency pairs do in traditional financial markets.

Perpetual futures contracts include a funding rate mechanism to align futures prices closely with spot prices. A positive funding rate indicates a bullish bias, while a negative rate suggests the opposite.

This change in the difference between the funding rates of Bitcoin and Ether coincides with the increase in the total market capitalization of crypto, led by altcoins. Although BTC’s market share has remained relatively stable, the total market capitalization of cryptocurrencies has increased significantly since early January.