TL;DR

- Scott Bessent confirmed in Davos that Donald Trump’s administration continues to uphold U.S. crypto policy and the strategic bitcoin reserve as official government guidelines.

- The executive order signed in March 2025 establishes that the reserve is funded with seized bitcoins and prohibits their sale.

- Bessent pointed to legislative progress to regulate the crypto sector, although the Senate postponed the vote due to disagreements over stablecoins and Coinbase’s withdrawal of support.

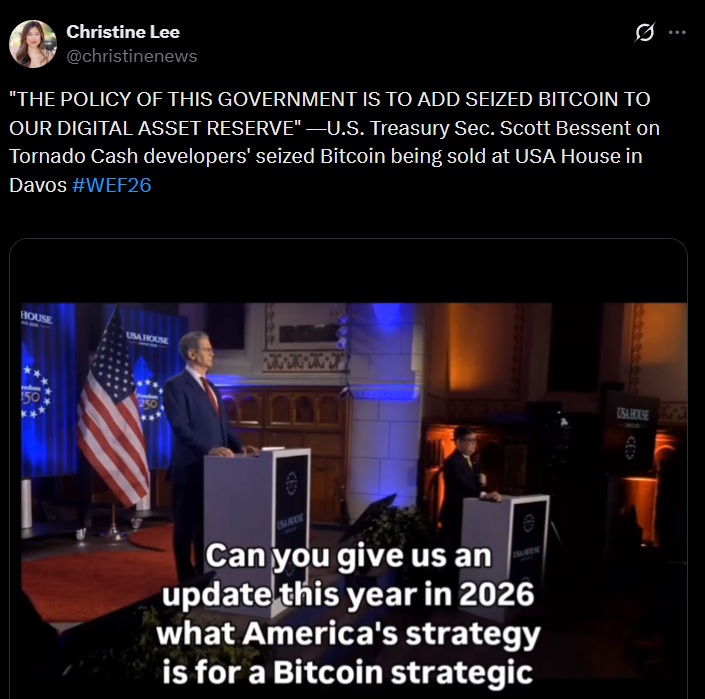

Scott Bessent reaffirmed in Davos the Donald Trump administration’s policy on digital assets and cryptocurrencies and the continuity of the United States’ strategic bitcoin reserve. The statement was made during the World Economic Forum, at a press conference attended by international media.

The Treasury Secretary said the administration aims to establish the most competitive regulatory framework for digital assets, designed to support their development and attract companies and technological activity to the country. The policy includes comprehensive regulation of the crypto sector and the relocation of projects and innovation within U.S. territory.

The Bitcoin Reserve Will Remain a Key Element for the Country

Bessent confirmed that the strategic bitcoin reserve remains in force as an official guideline. Trump signed an executive order in March 2025 instructing the federal government to retain its bitcoin holdings as a strategic asset. The order states that bitcoins included in the reserve cannot be sold under any circumstances.

The executive order specifies that the reserve will initially be formed with bitcoins seized through criminal or civil asset forfeiture processes. It also authorizes the search for budget-neutral mechanisms to expand holdings without using additional federal budget allocations.

Bessent Avoided Questions About Bitcoins Seized From Developers

During the conference, Bessent declined to answer questions regarding approximately $6 million in bitcoin seized from Samourai Wallet developers Keonne Rodriguez and William Lonergan Hill. Previous reports indicated that those assets may have been sold by the U.S. Marshal Service. The previous week, White House crypto adviser Patrick Witt stated that those bitcoins were not liquidated and remain under government custody.

Bessent explained that the Treasury’s current policy is to halt the sale of seized bitcoins and then add them to the digital asset reserve once the relevant legal proceedings are completed. He noted that this approach is already being applied.

The Secretary also referred to legislative efforts in Washington, D.C. to pass a law providing comprehensive regulation of the crypto sector. The bill seeks to establish clear rules for markets, issuers, and platforms operating with digital assets in the United States.

The legislative process was delayed last week. The Senate Banking Committee suspended a key hearing to amend and vote on its version of the bill. The postponement stemmed from disagreements over the treatment of stablecoin-related rewards and Coinbase’s withdrawal of support for the draft legislation