TL;DR

- Berachain, a Layer 1 blockchain compatible with EVM and based on Cosmos SDK, will launch its mainnet on February 6, 2025, alongside the Token Generation Event (TGE).

- The project has raised over $140 million in investments, including a $100 million Series B round in April 2024 and $42 million in 2023.

- It uses a three-token system (BGT, bera, and honey) and a “proof of liquidity” consensus model that combines staking and liquidity provision on DeFi platforms.

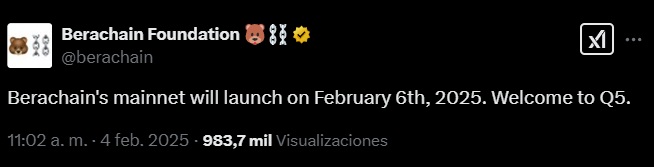

Berachain, a Layer 1 blockchain compatible with the Ethereum Virtual Machine (EVM) and built on the Cosmos SDK, is scheduled to launch its mainnet on February 6, 2025.

The announcement was made through its own foundation, which also stated that the Token Generation Event (TGE) will coincide with the mainnet launch. Berachain stands out for its innovative consensus system, called “proof of liquidity,” which aims to enhance the security and liquidity of the network by integrating staking with liquidity provision on DeFi platforms.

Over $140 Million in Investments

The project, which has been in development since late 2021, launched its testnet, Artio, in January 2024. Although the mainnet was initially planned for Q2 2024, its launch has been postponed to early 2025. The underlying technology in Berachain is unique, as it allows users to contribute to the network’s security by providing liquidity instead of relying solely on traditional staking.

Berachain has attracted the attention of investors. In April 2024, the platform raised $100 million in a Series B funding round, supported by Framework Ventures and the Abu Dhabi branch of Brevan Howard Digital. This investment adds to the $42 million the platform raised in a private token round in 2023, led by Polychain Capital.

Berachain’s Three Tokens

Berachain uses a three-token system: BGT, a staking token earned by providing liquidity to DeFi protocols; bera, the native gas token, obtained by burning BGT; and honey, the network’s native stablecoin. Users who delegate BGT to validators can earn rewards in honey and other incentives, while validators redirect rewards back into the ecosystem to maintain liquidity.

Berachain’s “proof of liquidity” system also allows protocols to integrate into the network’s liquidity pool, reducing costs and improving capital efficiency. Additionally, the network offers new opportunities for Cosmos validators, enabling them to attract capital and delegators from Ethereum, a growth opportunity for the Cosmos ecosystem