TL;DR

- Ripple enabled Permissioned Domains on the XRPL so banks can operate on-chain under verified regulatory frameworks.

- David Schwartz explained that low banking activity stemmed from regulatory constraints, due to the lack of guarantees around liquidity providers and verified counterparties.

- The ledger recorded 1.88 million payments and will launch a Permissioned DEX on February 18, featuring institutional pools for direct trading of large XRP volumes.

Ripple enabled a new infrastructure that allows banks to operate directly on the XRP Ledger within verified regulatory environments. This change seeks to address a long-standing limitation of the ledger: broad institutional adoption in agreements, but limited effective on-chain activity, despite more than 300 partnerships with financial institutions.

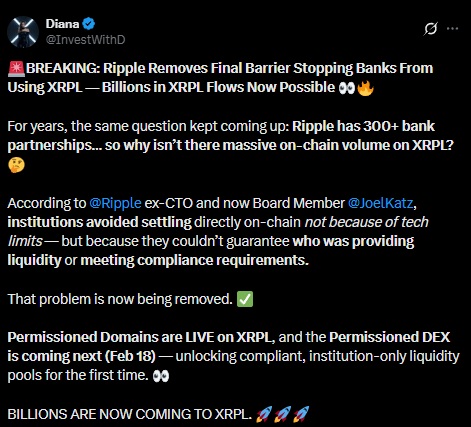

For years, direct use of the XRPL by banks remained limited. According to statements by David Schwartz, former Ripple CTO and current board member, the obstacle was not technical. The issue consistently lay in the lack of operational and regulatory assurances around liquidity providers. Institutions lacked a framework that ensured counterparties met strict regulatory standards, which blocked many potential flows worth billions of dollars.

Ripple introduced the so-called Permissioned Domains to fill that gap. This system allows regulated institutions to operate within verified networks where all participants meet compliance requirements. The implementation of this system enables direct on-chain settlements under structures compatible with the regulatory demands of the banking sector.

XRP Ledger Records Nearly 2 Million Payments

At the same time, activity on the XRP Ledger showed a notable increase. Payments recorded on the network reached 1.88 million, driven by the launch of new tools designed specifically for institutional use.

The next step will be the launch of a Permissioned DEX, scheduled for February 18. This platform will incorporate liquidity pools exclusive to institutions, allowing the trading of large XRP volumes directly on-chain. The DEX design aims to provide a regulated environment for liquidity provision and trade execution, something that had not previously been available on the ledger.

Institutional DEX on the Way

In addition, the rapid adoption of tokenized assets is also gaining momentum. A White House digital assets advisor projected that tokenization will reach mainstream use within a timeframe of one to three years. Tokenized commodities have already surpassed $5 billion, with activity currently concentrated on Ethereum, Polygon, and the Ledger.

With Permissioned Domains live and the institutional DEX on the way, the ledger now has an infrastructure oriented toward banks and regulated entities. The network will be able to channel settlements, trading, and liquidity provision under frameworks compatible with regulatory requirements and with direct execution on the blockchain