TL;DR

- Aster is trading at $1.62 after falling 15.4% in a day and more than 30% from the $2.43 peak reached on September 24, under growing sell pressure.

- The long/short ratio at 0.92 and the Accumulation/Distribution line confirm a predominance of shorts and a steady flow toward derivatives selling.

- The October 17 unlock will release 183M tokens worth $325M, 11% of the market cap, which could extend the correction or trigger a rebound.

Aster has deepened its pullback and is now trading at $1.62 after a 15.4% drop over the past 24 hours. The token has lost more than 30% since its all-time high of $2.43 set on September 24.

Its decline reflects both weakening demand and mounting pressure in the derivatives market. The long/short ratio remains at 0.92, signaling a predominance of short positions and bearish expectations among futures traders. The Accumulation/Distribution line also shows a steady flow into selling, confirming a lack of buying interest.

Immediate support lies between $1.60 and $1.71. If the price breaks below that range, the next key level sits at $1.25, which would deepen the retracement. To reverse the trend, Aster would first need to reclaim $2.03 and then $2.16, with the potential to retest the $2.43 high if it can hold above those levels.

Aster Could Rebound Up to 30% in October

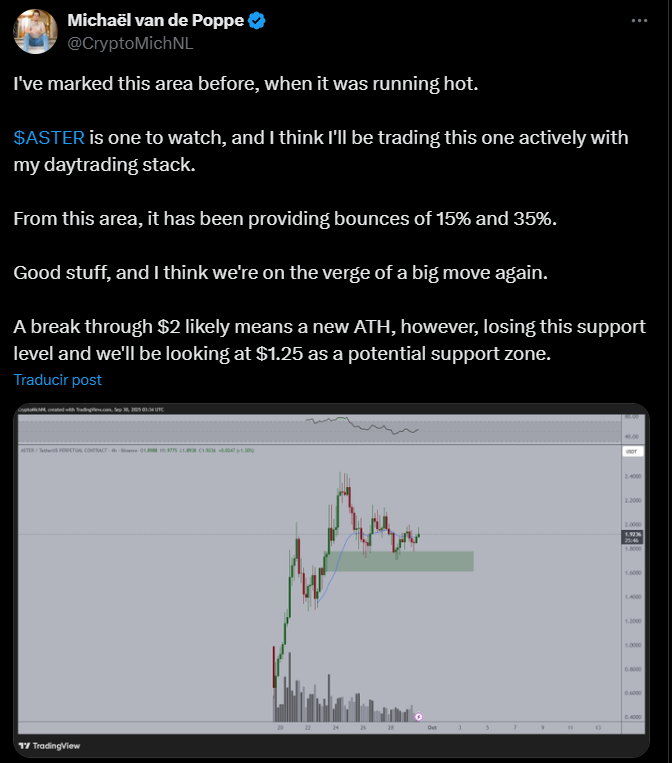

In this context, analysts such as Michaël van de Poppe suggest that the current range could serve as a base for a 15%–35% rebound in October. Other traders, like BitcoinHabebe, even project a rally to $3, supported by the formation of a descending wedge, a pattern that has historically preceded bullish reversals.

Attention is also focused on the scheduled October 17 unlock, when 183.13 million tokens—equal to 11% of the market cap and valued at around $325 million—will be released. The market currently sees about $1 billion in daily trading volume and a $2.26 billion TVL, which could absorb the additional supply. However, some view the unlock as a buying opportunity, while others believe it could intensify selling pressure.

The Aster team is considering adjusting the vesting schedule for airdrops to mitigate any risks, although the immediate reaction will depend on how the market behaves around the current support zone. October will be key to determining whether the pullback stabilizes or the correction deepens further