TL;DR

- The Monero community raised nearly $1M in 2025 through the CCS, which has collected over 35,900 XMR valued at $10M since 2020.

- This year’s funds—more than 2,200 XMR—financed core upgrades, the Carrot addressing scheme, wallets, nodes, and audits.

- The network continues to suffer selfish mining attacks from Qubic Pool, but XMR has rebounded 30% since August and is holding around $299.

Monero is going through a turbulent 2025, but also one marked by strong community support. Through its Community Crowdfunding System (CCS), users raised close to $1 million in donations for protocol development and related projects.

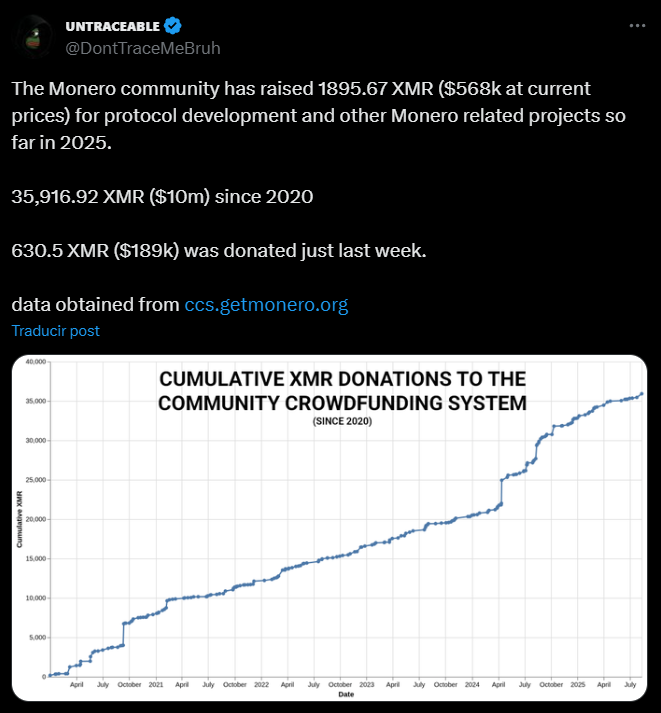

Data shows that between January and September, 1,895.67 XMR—worth about $568,000—were donated, while since 2020 the total has surpassed 35,900 XMR, valued today at around $10 million. In just the past week, 630.5 XMR were added, nearly $189,000, representing about one-fifth of all funds raised this year.

What Did the Community Donations Fund?

Most of the 2025 contributions—around 2,294 XMR—went into the protocol’s core. With that financing, developers implemented FCMP++, adjusted consensus rules, introduced optimizations, and launched a dedicated testnet. They also rolled out “Carrot,” a new addressing scheme, and expanded hardware wallet support.

Beyond the base layer, funds supported the development of Cuprate, a Rust-based node alternative, and wallets like Feather and Monfluo. Research into privacy improvements and defenses against spy nodes and 51% attacks was also financed, along with more operational tasks such as audits, code reviews, and integrating Monero into BTCPay Server.

All of the money flows through the CCS, hosted on getmonero.org. Since 2020, the system has established itself as a stable channel for community financing, with recurring contributions sustaining both large projects and smaller initiatives. The dataset published in September came from a contributor known as “Untraceable,” who detailed the donation flow and produced charts using automated analysis tools.

Monero Faces Constant Attacks

The contrast lies on the technical side. While the community is contributing more resources than ever, the network continues to deal with persistent selfish mining attacks from Qubic Pool. These cause deep chain reorganizations and orphaned blocks, raising questions about the system’s robustness. A recent example was an 18-block reorganization, which highlighted the protocol’s vulnerability.

On the market side, Monero’s token XMR has shown resilience. After hitting a low in August, its price rebounded nearly 30% to $299, a level it has held above the 50-day moving average. Technical indicators point to bullish momentum, although the sustainability of the trend will depend on how effectively the network can withstand the ongoing attacks