TL;DR

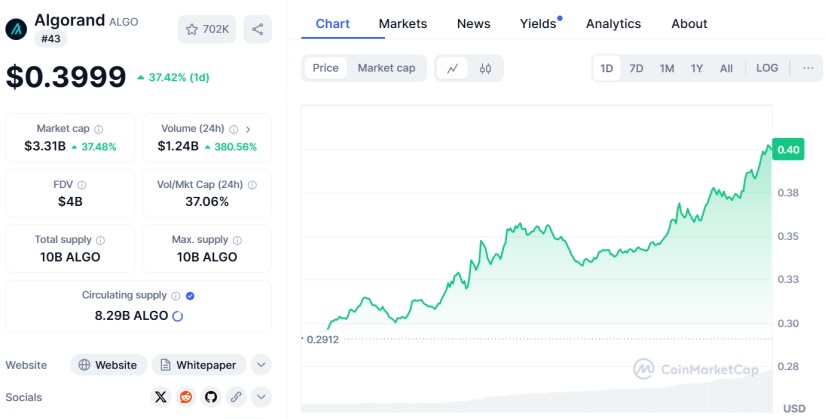

- Algorand (ALGO) reached a two-year high after a 37% increase in the last 24 hours, bringing its value to $0.3999, the highest level since November 2022.

- ALGO’s TVL has grown by 26%, reaching $157.97 million, while open interest in futures has risen to its highest level since November 2022.

- Despite the overbought condition indicated by an RSI of 79, analysts remain optimistic, with a target of $0.45 if the rally continues.

Algorand (ALGO) has reached a new two-year high following a strong 37% price increase in the last 24 hours. This marks a continuation of its bullish rally, which started in early November and has so far accumulated a total increase of 230%.

The surge has brought ALGO’s value to levels not seen since November 2022, reaching $0.3999. This momentum is supported by strong on-chain metrics. Open interest and TVL have reached record figures, suggesting that the market remains highly optimistic about the cryptocurrency.

On-Chain Metrics Surge

According to DefiLlama data, Algorand’s TVL has grown by 26% in recent days, rising from $125.25 million to $157.97 million. This is the result of increased activity within the Algorand ecosystem, indicating that more users are depositing and using assets in ALGO-based protocols. Additionally, Coinglass data shows that open interest in ALGO futures has also risen to its highest level since November 2022, reaching $95.87 million, meaning new funds are entering the market.

Forecast for Algorand (ALGO)

The increase in activity and interest has been complemented by the growing appeal of investments in Algorand, as the annualized yield (APY) of its assets has drawn significant attention from investors. However, some analysts warn that ALGO’s relative strength index (RSI), which is currently at 79, indicates that the cryptocurrency may be entering overbought territory, increasing the risk of a potential short-term correction.

Despite signs of overbought conditions, analysts remain optimistic, with some predicting that if the bullish trend continues, Algorand (ALGO) could reach the $0.45 target, a key resistance level observed in October 2022. However, a weekly close below $0.27 could invalidate the bullish thesis and trigger a drop toward $0.25.