TL;DR:

- Ripple minted 20 million RLUSD tokens, bringing the stablecoin’s total supply to 1.530 billion.

- The operation was executed on the Ethereum network from a wallet identified as “Ripple: Deployer”.

- RLUSD records a daily volume of over $100 million.

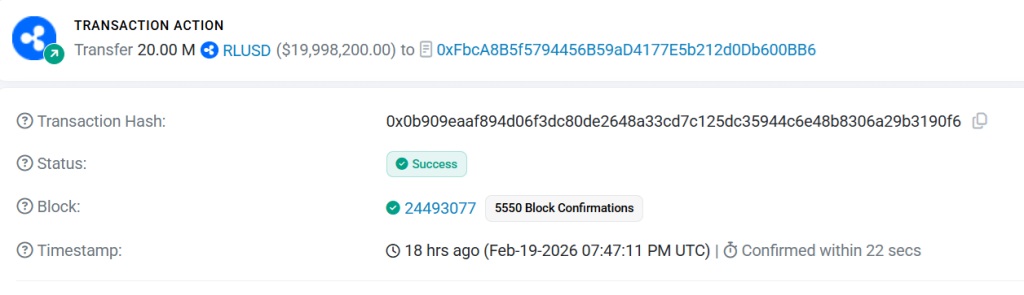

Ripple minted approximately 20 million RLUSD tokens, expanding the supply of its dollar-pegged stablecoin in an operation confirmed on February 19, 2026, on the Ethereum network. The issuance was recorded on Etherscan and executed from a wallet identified as “Ripple: Deployer”. The total supply of RLUSD has now reached 1.530 billion tokens, according to data from the company’s Stablecoin Tracker.

With this new batch of RLUSD tokens, the stablecoin is positioned in the mid-range of the stablecoin market in terms of capitalization. However, the gap with the sector’s leading players remains vast: Tether (USDT) exceeds $183 billion in market capitalization, while Circle’s USD Coin (USDC) surpasses $74 billion, according to CoinMarketCap.

RLUSD and Ripple’s Ecosystem Strategy

RLUSD is part of a strategy that the San Francisco-based company has been developing around custody infrastructure, real-world asset tokenization for institutions, and cross-border payment use cases. Supply increases in stablecoins typically respond to new institutional demand, treasury rebalancing, or liquidity provisioning for exchanges and DeFi platforms.

According to market data, RLUSD records a daily volume of over $100 million, indicating that the stablecoin shows active circulation rather than sitting idle in treasury reserves. It is worth noting that the issuance of 20 million tokens is not enough to alter the global stablecoin market, but it does improve the asset’s liquidity profile and Ripple’s standing as a tool for institutions and enterprises.

The real impact of the issuance will depend on whether counterparties adopt RLUSD to settle transactions, post collateral, or manage their own treasuries in the coming months. The liquidity available for payment flows, exchange pairs, and DeFi integrations on Ethereum grows with each expansion, though for that utility to be genuine, it requires adoption, not just supply.