TL;DR

- Mastercard, BlackRock, and Franklin Templeton are evaluating the use of the XRP Ledger to execute international payments, settlements, and asset issuance within their internal processes.

- The network enables faster transfers and lowers operating costs; testing remains in a technical evaluation phase.

- XRP acts as a bridge currency between currencies and tokens and removes the need for prefunded accounts; network volume reached 1.88 million real transactions.

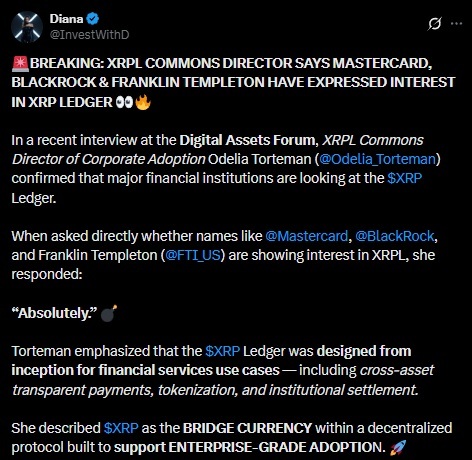

Large financial institutions have begun evaluating the XRP Ledger for operational uses. XRPL Commons confirmed that Mastercard, BlackRock, and Franklin Templeton are reviewing the network within their internal processes. Odelia Torteman, Director of Corporate Adoption, confirmed this during an interview at the Digital Assets Forum.

The analysis focuses on three areas: international payments, transaction settlement, and asset issuance. The entities aim to replace legacy infrastructure in cross-border transfers. The operational goal is to execute faster transfers, reduce settlement costs, and record movements in a verifiable way for the involved parties.

The Entry Point for Banks

Ripple recently removed a technical limitation for banks on the XRPL. After implementing several changes, the network can now be integrated without additional access layers. The companies remain in a technical evaluation phase and have not announced implementations or commercial agreements.

The XRP Ledger was designed for financial services from the start. The network supports payments across different assets, real-world asset tokenization, and institutional settlement. Its architecture avoids later adaptations on systems originally created for other purposes.

XRP Ledger Approaches 2 Million Transactions

The network’s payment volume reached 1.88 million transactions. The figure reflects real activity on the network. XRP functions as a bridge currency between fiat currencies and tokenized assets. This mechanism reduces the need to maintain prefunded accounts across multiple jurisdictions to execute international transfers.

A White House digital assets advisor projected mainstream tokenization adoption within 1 to 3 years. That scenario implies the development and use of networks capable of settling digital assets and traditional currencies within the same operational environment