TL;DR

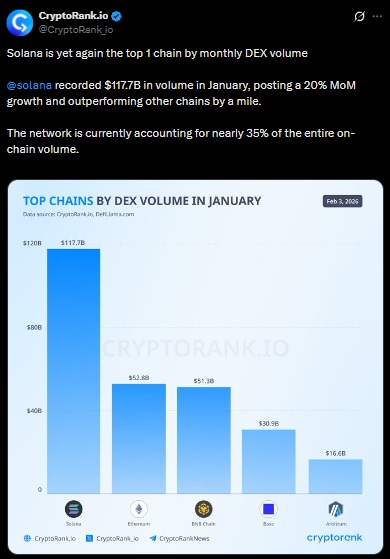

- Solana led on-chain volume on DEXs in January 2026, processing $117.7 billion in transactions and capturing nearly 35% of the market.

- The network reached all-time highs in transaction counts and the ratio of successful trades, maintaining a high operational level throughout the month.

- Despite the on-chain performance, SOL dropped 25% over the past week and currently trades around $93.7 per token, registering a nearly 5% decline in the last 24 hours.

Solana led on-chain volume on decentralized exchanges in January 2026. The network processed $117.7 billion in transactions, a 20% increase from December. Ethereum, BNB Chain, Base, and Arbitrum lagged far behind. At its peak, SOL accounted for nearly 35% of all on-chain DEX volume.

Transaction counts and overall network activity reached all-time highs. The ratio of successful to reverted transactions showed significant improvement. These figures indicate that the network maintained a high operational level throughout the month.

Solana Faces Intense Selling Pressure

Despite the strong on-chain performance, SOL’s price fell roughly 25% over the past week. The token retraced from the $120–125 range to the current $93.6, registering a 4.8% drop in the last 24 hours. The RSI shows intense short-term selling pressure.

Standard Chartered Adjusts SOL Forecast

Standard Chartered lowered its short-term forecast for SOL from $310 to $250. The bank projects medium- and long-term growth: $400 by the end of 2027, $700 by the end of 2028, and $1,200 by the end of 2029. According to Geoff Kendrick, Global Head of Digital Assets Research, activity on Solana DEXs is increasingly concentrated in SOL-stablecoin pairs, where stablecoins circulate faster than on Ethereum. Solana’s efficiency in stablecoin payments could enable new use cases, including AI-driven micropayments.

The data confirm that Solana maintains high on-chain activity while supporting significant DEX volumes and tokenized transactions. A 20% monthly increase in total volume and a 35% share of the DEX market demonstrate its absolute dominance over other networks