TL;DR

- Ethereum transaction fees fell to their lowest level since 2017, with the average cost per transaction dropping from $200 to $0.14.

- The decline follows the transition to Proof-of-Stake, the Fusaka and Dencun upgrades, and an increase in the per-block gas limit from 30 million to 36 million.

- Activity shifted toward Layer 2 networks such as Arbitrum and Base, while the base layer posted a record with more than 16 million monthly transactions.

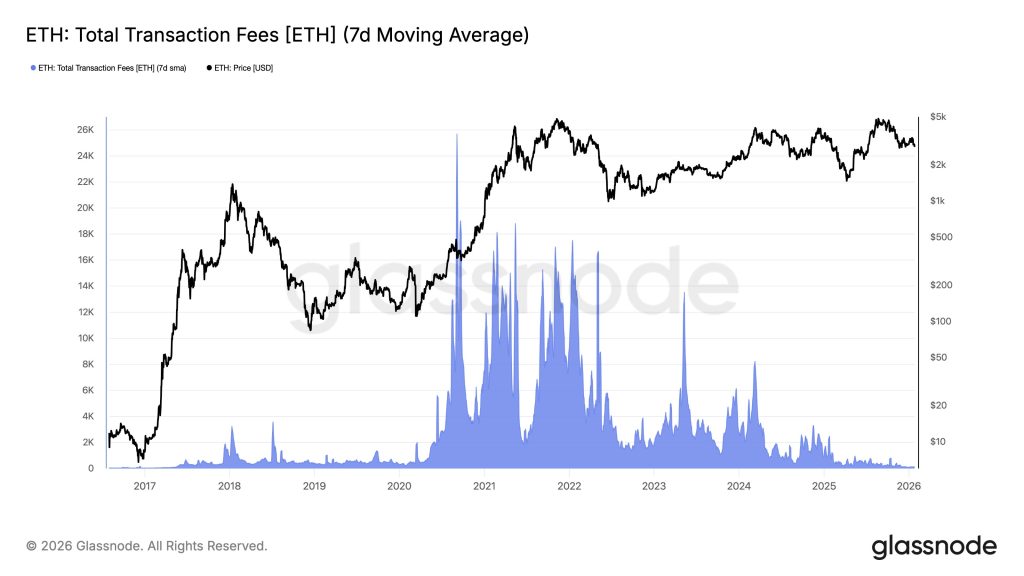

Ethereum transaction fees fell to their lowest level since 2017. The average cost per transaction dropped from peaks near $200 during the 2021–2022 cycle to $0.14 in 2026, according to Glassnode data. The decline coincides with a record high in transaction volume on the base layer.

The adjustment reflects a sequence of technical changes introduced since 2021. The transition to Proof-of-Stake reshaped Ethereum’s validation structure and removed direct reliance on transaction fees as the primary revenue source for protocol security. This was followed by the Fusaka and Dencun upgrades, which expanded processing capacity and improved block space efficiency. In addition, validators agreed to raise the per-block gas limit from 30 million to 36 million, increasing the number of transactions included in each block.

The Role of L2 Solutions

Activity also shifted toward scaling solutions. Layer 2 networks such as Arbitrum and Base absorbed a significant share of transactional flow, easing congestion on mainnet. This shift supported higher aggregate throughput without pushing fees higher on the base layer.

Historical data shows a gradual decline. After falling below $2 in November 2022, fees rebounded to $35 in March 2024. From February 2025 onward, the metric entered a concurrent downtrend. Over the same period, the total amount paid to validators dropped from a peak of 25,668 ETH, roughly $77 million, to a weekly average of 153 ETH, about $450,000.

Ethereum Records Around 16 Million Monthly Transactions

Despite the adjustment, Ethereum’s base-layer activity reached an all-time high. In January, monthly transaction volume exceeded 16 million. Compared with 2021, the network now processes nearly three times as many transactions at a substantially lower unit cost.

Ethereum’s validator economics remain anchored in staking rewards, with yields near 3% annually. Transaction fees and MEV play a secondary role within that structure. This setup also lowers operating costs for onchain infrastructure layers, such as oracles and data availability systems, which rely on frequent updates.

At present, ETH trades around $2,714, down 7.7% over the past 24 hours. The price remains close to levels seen a year ago, after surpassing $4,770 in August 2025