TL;DR

- U.S.-listed spot Bitcoin and Ethereum ETFs saw nearly $1 billion in outflows in a single session.

- BTC dropped below $85,000 and ETH to $2,700. The ETFs lost $817.9 million and $155.6 million, respectively.

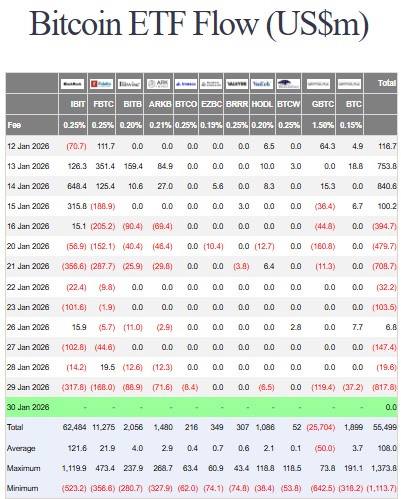

- The largest outflows came from BlackRock IBIT ($317.8M), Fidelity FBTC ($168M), and Grayscale GBTC ($119.4M).

U.S.-listed spot Bitcoin and Ethereum ETFs recorded nearly $1 billion in outflows in a single session, marking one of the strongest redemption days of 2026. Falling prices, higher volatility, and reduced risk appetite led investors to withdraw funds from major products managed by BlackRock, Fidelity, and Grayscale.

Bitcoin fell below $85,000 and briefly touched $81,000 before stabilizing near $83,000 during Asian trading hours. Ethereum dropped more than 7% in the same period, hovering around $2,700. According to SoSoValue data, investors withdrew $817.9 million from Bitcoin spot ETFs, the largest outflow since November 20. Ether ETFs recorded $155.6 million in redemptions, reducing total assets to $16.75 billion from over $18 billion earlier in the month.

The largest outflows were concentrated in the biggest ETFs. BlackRock IBIT lost $317.8 million, Fidelity FBTC $168 million, and Grayscale GBTC $119.4 million. Other products, including Bitwise, Ark 21Shares, and VanEck, also recorded significant outflows. For Ethereum ETFs, BlackRock ETHA lost $54.9 million and Fidelity FETH $59.2 million.

Bitcoin Fell on Macro Data and Fed Rate Expectations

The simultaneous selling across both products reflected broad reductions in exposure by institutional investors. In January, inflows into Ether ETFs often offset weakness in Bitcoin; this pattern has not persisted recently.

Market pressure coincided with rising implied volatility, weakness in equities, and speculation over U.S. Federal Reserve policy, with expectations of higher rates. Leveraged positions in cryptocurrencies were unwound aggressively, adding pressure to spot prices.

Analysts note that ETF flows have followed price action rather than leading it. As long as BTC and ETH remain under pressure, ETF demand is expected to remain fragile, with investors waiting for volatility to ease before reinvesting.