TL;DR

- Veera added one-click cross-chain swaps and a unified multi-asset yield hub, enabling asset transfers and yield management.

- The hub centralizes positions across different assets and networks, integrates onchain tools into a single workflow, and removes the need for multiple wallets.

- The platform has raised a total of $10 million in funding.

Veera added two new features to its onchain platform: one-click cross-chain swaps and a unified multi-asset yield hub. These new tools allow users to move assets and manage yields across multiple blockchains from a single operational interface. The launch followed the close of a funding round that brought total capital raised to $10 million.

The multi-asset yield hub centralizes the management of yield positions across different networks and assets. Users can view, manage, and maintain positions from a single environment, without the need to operate multiple wallets, external dashboards, or independent protocols. The infrastructure aggregates yield tools available across several blockchains and integrates them into a single operational flow.

In addition, the system removes the need to execute repetitive manual processes to deploy assets across different networks. Positions are recorded within the system and integrated into the overall operation of Veera’s product. The design targets users who run recurring yield-generation strategies across multiple assets and chains.

The second feature enables cross-chain swaps through a single action. The system executes exchanges across blockchains and protocols without requiring users to manage bridges, approvals, or chained transactions. All operations are processed in the background within Veera’s infrastructure and reflected as a single transaction in the interface.

Veera: A Global Onchain Neobank

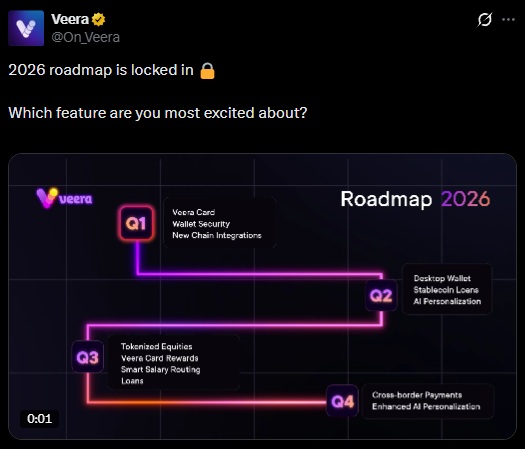

Both features are part of Veera’s core product, defined as a global onchain neobank. The company launched its official product in January 2025 and continues to roll out new tools on an ongoing basis.

Veera recently closed a $4 million seed round, which included $2.8 million from CMCC Titan Fund and Sigma Capital, along with strategic angel investors. This capital was added to a $6 million pre-seed round closed in May 2024, led by 6th Man Ventures and Ayon Capital, with participation from Folius Ventures, Reflexive Capital, Sfermion, Cypher Capital, Accomplice, and The Operating Group.

Since its launch, the platform has surpassed 2 million downloads and supports more than 300,000 multichain self-custody wallets. It records around 220,000 monthly active users and 20,000 daily active users. Onchain activity exceeds 500,000 transactions per month.

Veera also reports 70,000 holders of its RWA Gold Token (VGT). The project began as a privacy-focused Web3 browser and evolved into an integrated onchain financial platform