TL;DR

- Dogecoin closed January with a 3.51% monthly gain and ended a four-month losing streak, following declines of 20%, 21.3%, and 19.9% between October and December 2025.

- DOGE is currently trading at $0.1156 after falling 7% over the past 24 hours, remains below the $0.125 level, and posts a daily trading volume of $1.29 billion.

- The correction coincided with a drop in the RSI to 42.59 and a high correlation with Bitcoin.

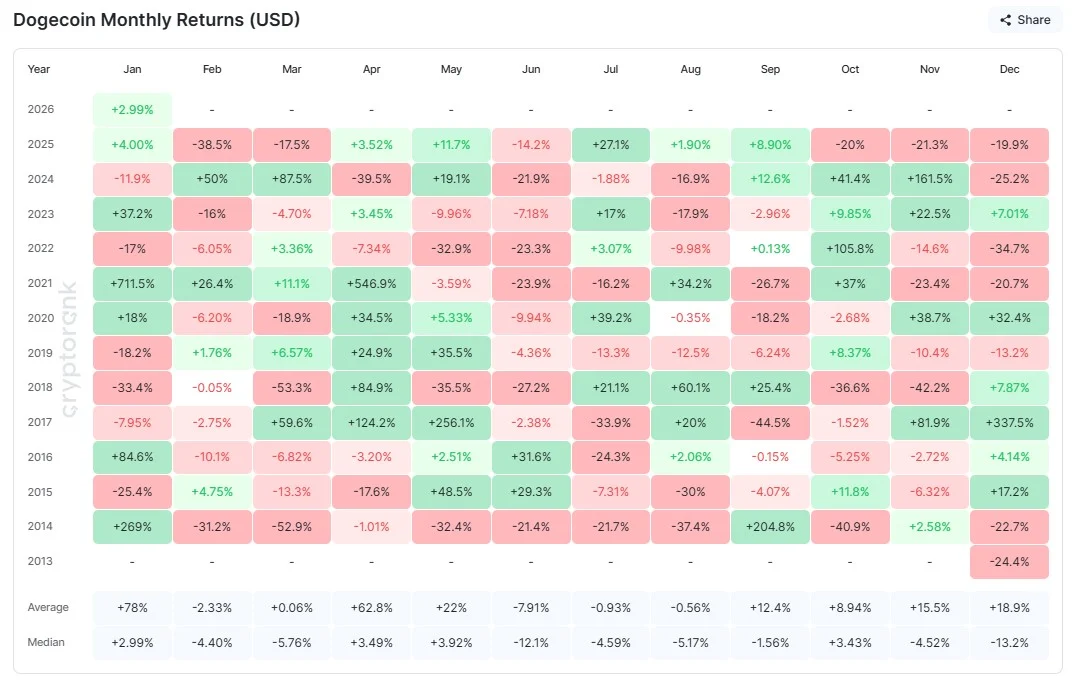

Dogecoin closed January with a positive monthly change of 3.51%, according to Cryptorank data, bringing an end to four consecutive months of negative closes. The streak began in October 2025 and extended through December of the same year, a period during which the asset recorded sizable monthly losses.

In October, DOGE posted a 20% decline. In November, losses reached 21.3%. In December, its price fell another 19.9%. These sharp drawdowns occurred in months that, based on historical records, typically show positive average performance for the memecoin. January, for its part, carries a historical average return close to 78%, although the current increase remains well below that level.

Dogecoin Trades Lower Amid Market Correction

Amid the current broad market correction, Dogecoin is trading at $0.1156, down 7% over the past 24 hours, according to CoinMarketCap data. Its price remains below the recent intraday high of $0.127 and below the $0.125 level, which had acted as support since October 2025.

Daily trading volume stands at $1.29 billion, marking a 1.4% contraction over the past 24 hours. Earlier in the month, volume recorded steeper declines, associated with lower market activity and regulatory restrictions imposed in the United States and Russia.

High Correlation With Bitcoin

On the technical side, the Relative Strength Index sits at 42.59, according to the indicators cited in the original report. The reading remains below the neutral threshold and far from oversold levels. The loss of the $0.125 support remains in place, and the token trades within a lower range than that observed during much of the fourth quarter of 2025.

Dogecoin’s current performance aligns with that of other crypto market assets and with movements in Bitcoin’s price, to which DOGE has shown a high correlation in recent months. The adjustment seen in the last quarter was directly reflected in the token’s price and in the reduction of its trading volume.

Heading into the monthly close, Dogecoin retains a positive balance for January despite the latest correction. It enters February with a historical monthly record in which Shiba Inu has delivered stronger relative performance in previous cycles