TL;DR

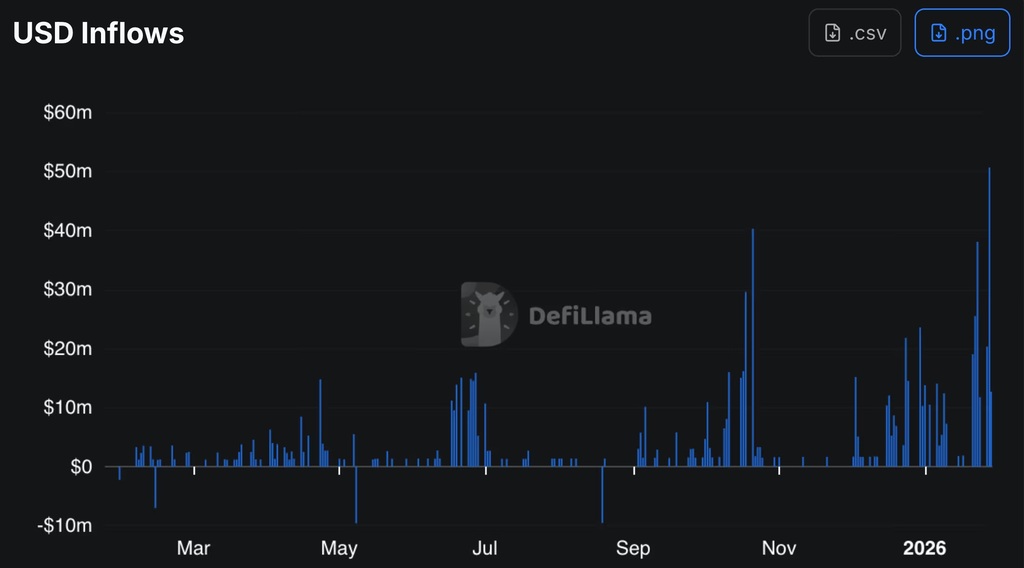

- Investors are piling into tokenized gold, with Paxos Gold (PAXG) seeing record January inflows.

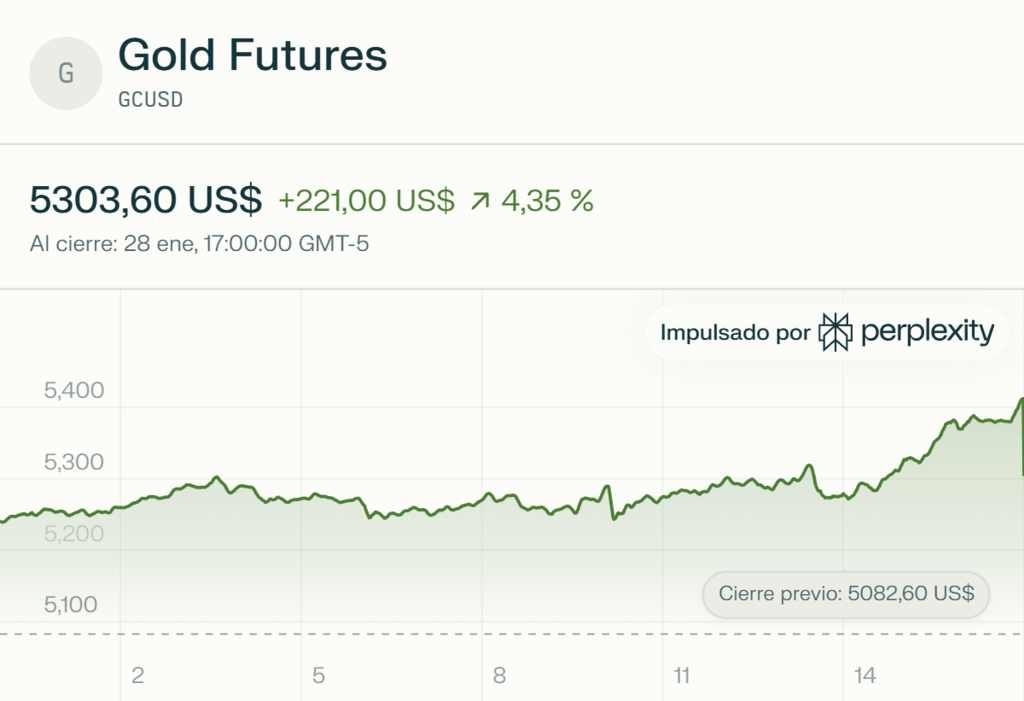

- Surging physical gold prices above $5,300 drive value and demand for the blockchain-backed tokens.

- Tokens enable fractional ownership, 24/7 liquidity, and utility within DeFi ecosystems.

Crypto investors are piling into tokenized gold while digital asset markets remain stagnant, sending inflows to Paxos’ gold token to a record in January.

Paxos Gold (PAXG), backed by physical gold stored in LBMA vaults in London, accumulated over $248 million in fresh capital during January, DefiLlama data shows. The flow lifted PAXG’s market capitalization above $2.2 billion.

The wave of inflows coincides with gold enjoying a blistering rally. The precious metal crossed $5,300 per ounce on Wednesday, climbing 22% through January and gaining over 90% in the past year. Meanwhile, Bitcoin dropped more than 10% in a year and the broader crypto market sank.

The dynamic has shifted some crypto investors’ attention toward blockchain-based gold, looking for protection in an uncertain macro environment, said James Harris, CEO of crypto yield platform Tesseract Group.

“The growing traction of tokenized gold has improved gold’s utility, particularly around transferability and divisibility,” Harris noted, “while Bitcoin continues to trade more like a risk asset in periods of macro uncertainty.“

Tokens Offer Fractional Ownership with Verifiable Custody

Tokens like PAXG and XAUT offer fractional ownership of physical gold, with blockchain-based transfers and crypto wallet compatibility. For investors, it represents a way to hold a centuries-old store of value without needing a vault.

The total tokenized gold market topped $5.5 billion, according to CoinGecko, marking an all-time high as both inflows and gold prices push the sector to new heights.

The contrast between gold’s performance and Bitcoin reflects shifts in risk perception. Investors traditionally viewed cryptocurrencies as inflation hedges, similar to gold. However, Bitcoin’s recent behavior aligns it more with technology stocks than safe-haven assets.

PAXG allows holders to redeem tokens for physical gold if they possess minimum amounts, maintaining the link between the digital asset and underlying metal. Each token represents one fine troy ounce of 400-ounce gold stored in professional vaults.

Blockchain transfers eliminate traditional intermediaries in gold trading, reducing transaction costs and settlement time. Investors move PAXG between wallets in minutes, compared to days for physical gold transfers.

Tokenization also enables unprecedented divisibility. Investors buy fractions of an ounce without the minimum size restrictions of physical gold. A buyer can acquire $100 in PAXG, impossible with standard gold bars.

The physical gold rally drives value for backed tokens. When spot gold rises, PAXG and similar products increase proportionally, maintaining parity with the underlying asset. Record gold prices amplified returns for token holders in January.

Other gold tokens recorded similar activity. Tether Gold (XAUT) also saw increases in market capitalization during the same period, though smaller than PAXG. The entire tokenized precious metals sector attracted capital.

The correlation between macroeconomic uncertainty and gold demand holds in digital formats. Geopolitical tensions, inflation concerns, and volatility in traditional markets historically drive gold purchases.

James Harris emphasized that blockchain infrastructure improves gold use cases beyond simple storage. Tokens enable collateral in DeFi protocols, cross-border payments, and instant settlement without the frictions of physical gold.

The growth of the tokenized gold market to $5.5 billion represents only a fraction of the global gold market, valued in trillions. However, the adoption rate accelerates as more investors discover tokenization benefits.

PAXG operates with regular audits of gold reserves. Holders can verify tokens in circulation correspond to stored gold. Blockchain transparency adds a verification layer absent in traditional gold certificates.

The January record inflows occurred against a backdrop of crypto market consolidation. Bitcoin traded sideways between $85,000 and $95,000 for most of the month, offering little directional momentum for traders.

Gold’s surge past $5,300 attracted attention from crypto-native investors seeking alternatives to volatile digital assets. The tokenized format allows participation without leaving crypto infrastructure or converting to fiat currencies.

PAXG’s compatibility with DeFi protocols expands utility beyond simple holding. Users can stake tokens, provide liquidity, or use them as collateral for loans, generating yield while maintaining gold exposure.

The token’s 24/7 trading availability contrasts with traditional gold markets limited to business hours. Crypto investors access gold exposure at any time, matching the always-on nature of digital asset markets.

Regulatory clarity around gold-backed tokens in major jurisdictions supports institutional adoption. Clear legal frameworks define custody requirements and redemption rights, reducing counterparty risk compared to unbacked crypto assets.

The $248 million January inflow marks the highest monthly total since PAXG launched. Previous records occurred during market stress periods, reinforcing gold’s role as a safe haven even in tokenized form.