TL;DR

- Bitcoin has delivered stronger cumulative returns than gold since 2022, based on multi-year market data cited by analysts.

- Recent price consolidation around $90,000 has raised short-term concerns, but broader comparisons still favor BTC over traditional safe-haven assets.

- Analysts link both the past rally and the current slowdown to the rollout of spot Bitcoin ETFs, arguing that the market is absorbing earlier gains rather than showing structural weakness.

Bitcoin has outperformed gold since 2022, according to analysts who argue that recent market hesitation masks a broader trend favoring digital assets. While short-term price movements have tested investor confidence, longer-term comparisons continue to place Bitcoin ahead of traditional stores of value. The data suggests that volatility has not erased Bitcoin’s relative strength, even as global markets remain cautious.

Bitcoin trades near $90,000 as of late January 2026, following several weeks of uneven price action. This range-bound behavior has unsettled traders focused on short timeframes, particularly after repeated failures to sustain moves above resistance levels. Analysts reviewing multi-year performance, however, emphasize that these fluctuations look limited when viewed against Bitcoin’s gains since the 2022 market lows.

Bitcoin Has Outperformed Gold Since 2022 In Relative Returns

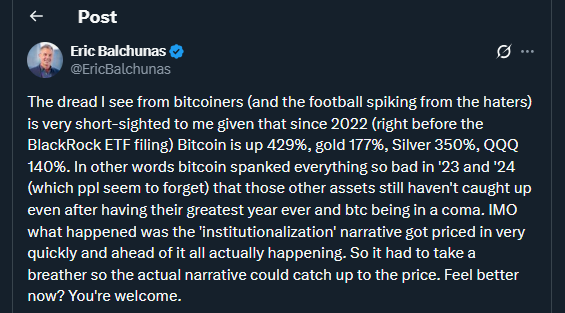

Eric Balchunas, an ETF analyst, highlighted that Bitcoin has risen more than 400% since 2022, compared with gold’s increase of under 200% over the same period. Other assets, including silver and major U.S. equity indices, also trail Bitcoin in cumulative performance. These figures illustrate how sharply BTC rebounded after the 2022 downturn and why its longer-term chart still differs from traditional assets.

A significant portion of that appreciation occurred around the period when major asset managers filed for spot Bitcoin ETFs in the United States. Prices adjusted quickly to expectations of broader institutional access, lifting valuations before actual inflows fully developed. Analysts argue that this early repricing explains why Bitcoin now trades more cautiously, as the market allows adoption trends to catch up with price.

ETFs And Market Structure Influence Current Price Action

Spot Bitcoin ETFs now provide regulated exposure for a wide range of investors, including pension funds and wealth managers. Holdings across these products amount to hundreds of thousands of BTC, creating a different market structure than in earlier cycles dominated by retail speculation. As a result, price movements have become less explosive, but also more resilient during periods of stress.

Broader macroeconomic factors have also played a role. Uncertainty around U.S. monetary policy and periodic liquidations in derivatives markets have added pressure to Bitcoin in recent weeks. Even so, Bitcoin’s market dominance remains elevated, indicating that capital has not rotated aggressively into alternative cryptocurrencies during the pullback.