TL;DR

- A chart compared the 2021–2022 cycle with the current one and showed a structural shift, with Ethereum trading near $3,100 within an ascending channel.

- BitMine transferred $270.618 million in ETH to a staking address and raised its total position to about $5.521 billion, according to on-chain data.

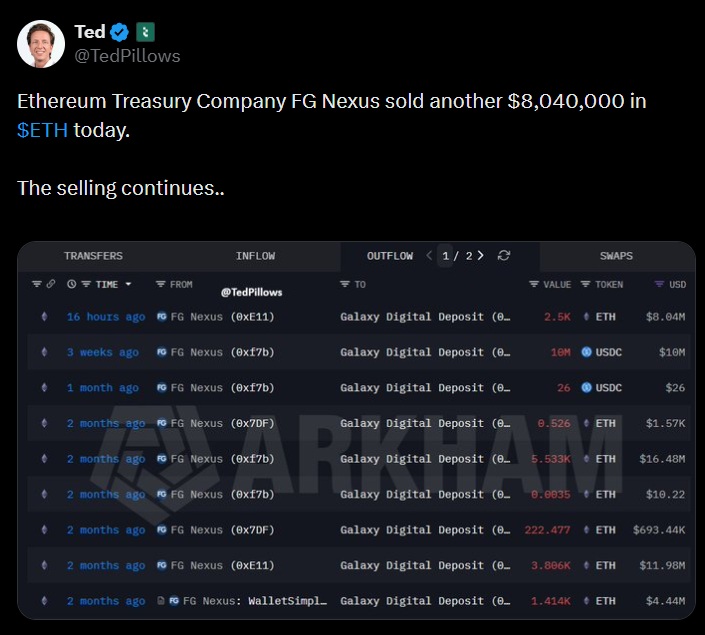

- FG Nexus sent roughly 2,500 ETH, valued at $8.04 million, to a wallet identified as Galaxy Digital Deposit.

Ethereum showed two simultaneous institutional flows based on technical data and on-chain movements. On one side, a comparative chart highlighted structural differences between the 2021–2022 cycle and the current one. On the other, wallets linked to BitMine and FG Nexus executed transfers totaling more than $278 million in ETH toward staking and custody.

A chart shared by the Max Crypto account compared Ethereum’s price structure against the U.S. dollar across both cycles. In the 2021–2022 phase, the setup showed a head-and-shoulders formation following a prolonged uptrend. The break of an ascending support line preceded a decline of roughly 65% over a period of about two months, according to the chart’s annotations.

Ethereum Shows an Inverse Structure in the Current Cycle

In the current cycle, the image presented an inverse structure. The pattern included a lower low acting as the head and two higher lows forming the shoulders. Price action developed within an ascending channel, with an upward-sloping neckline across recent highs. At the marked point, Ethereum traded near $3,100.

Staking and Custody

In parallel, movements from institutional wallets were recorded. According to data shared by the TedPillows account, BitMine increased its Ethereum staking activity. The firm transferred $270.618 million in ETH to a staking address, lifting its total staked position to about $5.521 billion.

Transaction records showed multiple outflows from wallets labeled as BitMine to the same address, identified by the 0x9212 prefix. The transfers included 24,544 ETH, 16,992 ETH, 24,544 ETH, and 20,768 ETH. The associated values ranged between $54.67 million and $78.97 million per transaction, based on prices at the time of each operation.

On the other side, FG Nexus sent ETH to an address identified as Galaxy Digital Deposit. The transaction involved roughly 2,500 ETH, with an estimated value of $8.04 million. The record was described as an additional outflow from the firm’s treasury to a trading and custody provider.

Both flows were reflected in on-chain data on the same day. While BitMine routed ETH to validation contracts, FG Nexus transferred assets to an institutional custody entity. The transfers coincided with the technical comparison between cycles, and no changes to protocols, consensus rules, or network parameters were reported