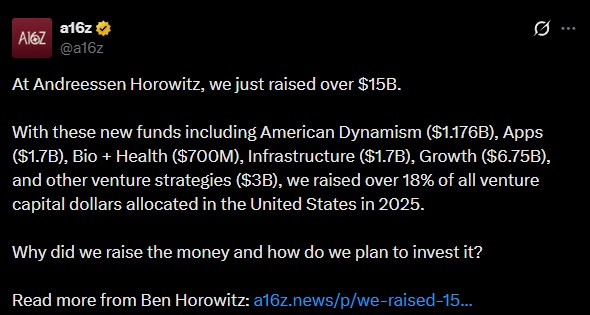

a16z raised over $15 billion across five separate funds to drive the development of future technologies in the United States, representing more than 18% of all venture capital raised in the country in 2025.

The capital will be allocated to American Dynamism ($1.176B), Apps ($1.7B), Bio + Health ($700M), Infrastructure ($1.7B), Growth ($6.75B), and other venture strategies ($3B). The firm aims to lead in key architectures such as AI and crypto, applying them in biology, health, defense, public safety, education, and entertainment.

Although no specific allocation was made to the crypto sector, a16z crypto has led some of the largest investments in the space, including Coinbase, Solana, Uniswap, OpenSea, and Phantom. In 2025, the firm invested in Kalshi ($300M), EigenLayer ($70M), and Solana DeFi (Jito). Since 2018, a16z has raised over $7 billion to invest in crypto protocols and companies.

The firm stated that its mission is to ensure the United States leads in technology over the next 100 years, warning that a lack of U.S. technological leadership would have global economic, military, geopolitical, and cultural consequences.

Source: https://x.com/a16z/status/2009622690081223135

Disclaimer: Crypto Economy Flash News are based on verified public and official sources. Their purpose is to provide fast, factual updates about relevant events in the crypto and blockchain ecosystem.

This information does not constitute financial advice or investment recommendation. Readers are encouraged to verify all details through official project channels before making any related decisions