TL;DR

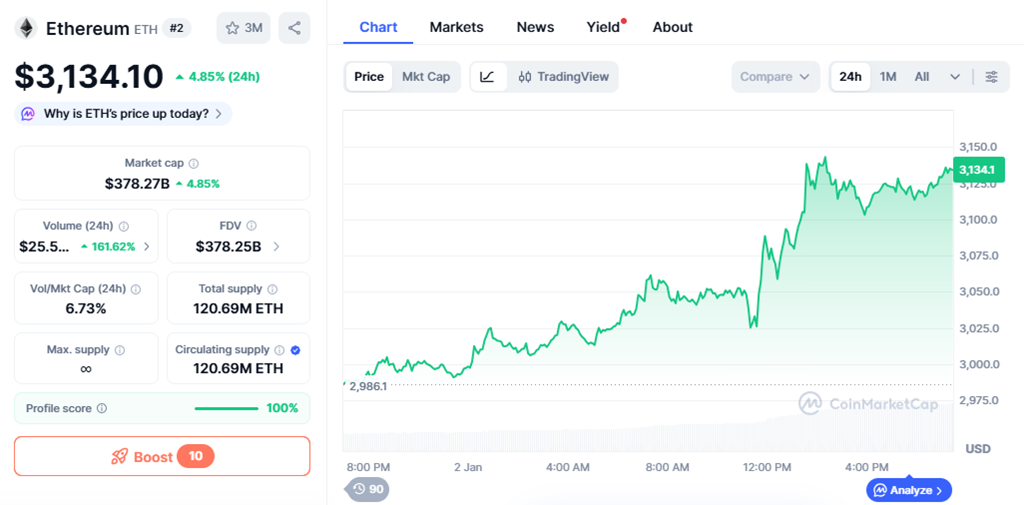

- Ethereum ($3134) has gained 4.85% in the last 24 hours, showing strength against Bitcoin.

- Technical analysis indicates that the ETH/BTC pair could be exiting a prolonged accumulation range, similar to past cycles where Ethereum significantly outperformed Bitcoin.

- Key levels to watch include $3,600 as psychological resistance and $1,800 as high-conviction accumulation zone, highlighting areas that may determine the next phase of relative performance.

Ethereum has gained momentum over the past 24 hours, rising 4.85% to $3134, while the ETH/BTC pair remains in a re-accumulation phase that analysts see as critical. Crypto trader Merlijn The Trader points out that the current structure resembles previous cycles where Ethereum consolidated against Bitcoin before entering strong relative performance phases. The prolonged accumulation and compressed volatility suggest the cryptocurrency could be positioning for a significant move. Investors and market participants are closely monitoring daily volumes, which also reflect increased interest in ETH relative to BTC.

What the Chart Signals About ETH/BTC

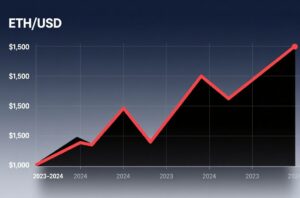

Technical analysis highlights two major historical phases: 2015–2018 and 2018–2025. In both periods, Ethereum first went through a sideways accumulation after steep declines, followed by a re-accumulation with lower highs and descending volatility channels. Merlijn notes that if the current pattern repeats, a sustained breakout could push ETH/BTC above prior levels and increase Ethereum’s relative advantage over Bitcoin. Observing short-term momentum indicators alongside this long-term structure provides further confirmation of potential upside.

Key levels to monitor are clear. A sustained move above $3,600 psychological resistance would strengthen the bullish case, while a pullback toward $1,800 would likely extend the accumulation phase rather than signal a structural failure.

Why This Cycle Could Lead to a Stronger Move

Although the structure resembles previous cycles, the market environment has changed: Ethereum now has a larger market capitalization, higher institutional participation, and more liquidity across spot, derivatives, and ETFs. This suggests that any breakout could be driven by broader capital flows rather than just retail speculation, potentially translating into more sustained and significant movements in ETH/BTC. Traders are also tracking staking activity and exchange outflows, which provide additional insight into market supply dynamics.

Ethereum is once again at a critical point against Bitcoin. Historical patterns show that similar structures preceded major upside moves. If the current setup confirms, the next phase could redefine Ethereum’s position in the market cycle, positioning the cryptocurrency for potential leadership against Bitcoin.