TL;DR

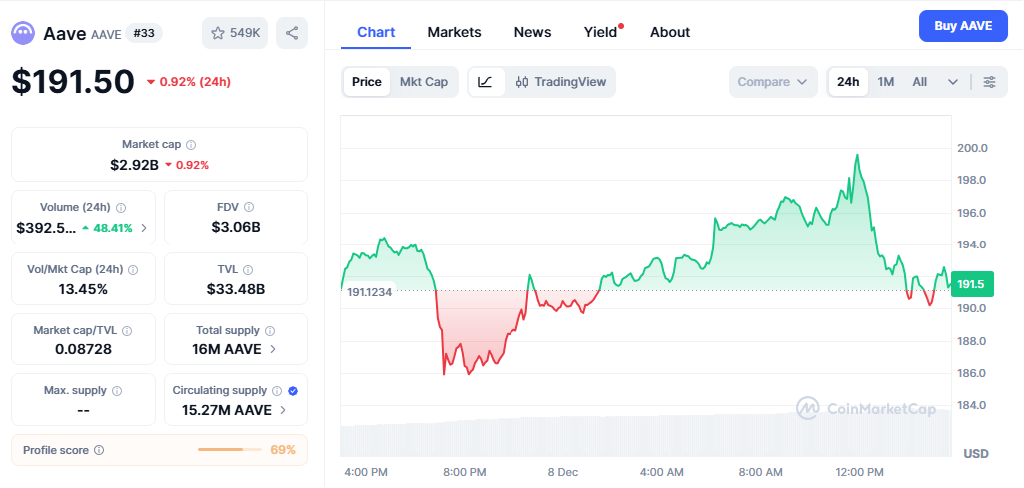

- Aave trades at $191.50 after a -0.92% move in the past 24 hours, while the token shows renewed strength supported by rising DeFi activity.

- Market cap stands at $2.92 billions, with liquidity inflows boosting institutional attention.

- Analysts point to a potential breakout above $200 if buyers keep control and momentum holds.

Aave price draws renewed attention as the token holds near $191.50 after a mild decline in the latest session. The move reflects stronger engagement across decentralized finance and a broader recovery trend in major cryptocurrencies.

Aave Price Momentum Shows Fresh Demand

The current Aave price structure remains inside a medium-term descending channel, although buyers have improved their position compared with the lows of late November. The token stays well above the $147 mark recorded on 21 November and continues to approach the upper end of its pattern. With a market cap of $2.92 billions, Aave shows growing participation in its lending markets as borrowing and liquidity expand.

Recent on-chain data reveals notable increases in stablecoin flows, especially USDT deposits, entering Aave’s pools. This movement often aligns with higher lending activity and supports a stronger base for the token. The broader landscape remains favorable, with Bitcoin above $90k, Ethereum near $3,100 and Solana attracting steady demand. These dynamics reinforce the appeal of established DeFi protocols such as Aave.

Technical Conditions Support Aave Price Prospects

Short-term indicators display moderate strength, with the Relative Strength Index near 52 and trending upward. Aave also moved above its 50-day EMA, a signal that has historically preceded expansion phases. Resistance around $200 remains active, yet buyers continue to challenge this level with rising consistency.

Historical action during 2025 shows that Aave tends to accelerate once it secures a clean break above similar barriers. Between May and August, the token advanced toward $385 after clearing key resistance zones. While volatility still influences short-term shifts, current positioning suggests bulls are ready to defend $178 and $186 as supports.

A confirmed move above $200 could open space toward $227 in the short term, while stronger market momentum may revive interest near $300. A sharp decline in Bitcoin below $90k could slow this path, although prevailing conditions still lean toward gradual appreciation.

Aave maintains a constructive setup backed by expanding DeFi activity, stronger liquidity inputs and supportive technical signals. If buyers consolidate control above $200, the token may extend its recovery and rejoin the group of outperforming large-cap DeFi assets.