TL;DR

- Sovereign wealth funds bought Bitcoin during recent price declines.

- Abu Dhabi’s funds hold over $1.1 billion in BlackRock’s Bitcoin ETF.

- Bhutan’s sovereign fund mines Bitcoin using 100% renewable hydropower.

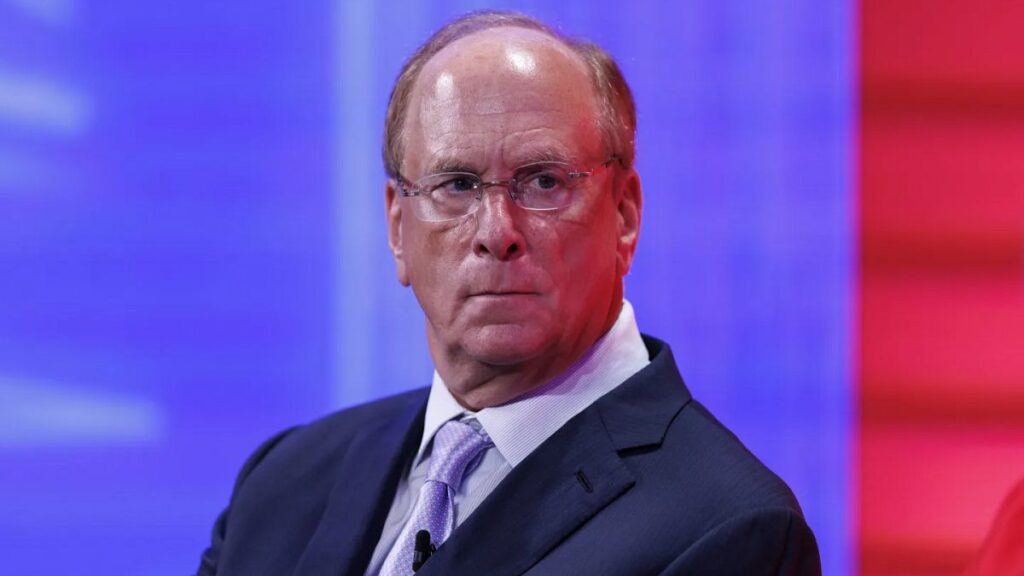

The CEO of BlackRock, Larry Fink, stated that sovereign wealth funds increased their Bitcoin holdings during recent price declines. Fink made this statement at the New York Times DealBook Summit.

These state-owned investment funds used price dips at $120,000, $100,000, and below $90,000 to accumulate Bitcoin gradually. Fink clarified that the purchases are not short-term trades. They represent long-term positions with a multi-year investment horizon.

Abu Dhabi, Luxembourg, and Bhutan Lead Adoption

Concrete data shows activity from Abu Dhabi’s funds. The Abu Dhabi Investment Council tripled its holdings of BlackRock’s iShares Bitcoin Trust in the third quarter of 2025. Its position reached nearly 8 million shares, worth approximately $518 million.

Another fund, Mubadala Investment Company, held 8.7 million shares valued at about $567 million at the end of September. Combined, these two funds control over $1.1 billion in this investment vehicle.

Separately, Luxembourg’s Intergenerational Sovereign Wealth Fund made a direct allocation to Bitcoin in October 2024. It was the first sovereign fund in the Eurozone to do so. The fund allocated 1% of its portfolio, roughly $9 million, to Bitcoin exchange-traded funds. It chose this route to reduce custody risks.

Bhutan executes a different strategy. Its sovereign fund, Druk Holding & Investments, mines Bitcoin using 100% renewable hydropower. The country began mining in 2019 and now produces between 55 and 75 Bitcoins each week. It currently holds over 13,000 Bitcoins, a value roughly equivalent to 30% of the nation’s gross domestic product.

BlackRock’s IBIT Fund Maintains Lead Despite Outflows

BlackRock’s iShares Bitcoin Trust remains the world’s largest Bitcoin ETF. It manages approximately 776,475 Bitcoins, with a value near $72 billion. This figure represents 59% of all Bitcoin held by U.S.-approved spot ETFs.

However, the fund recorded net capital outflows during November 2025. It lost around $21 billion in combined assets under management. Crypto Economy analysts link some of these outflows to the unwinding of arbitrage trades, not to large-scale institutional selling.

Fink Describes Bitcoin as an “Asset of Fear”

Larry Fink’s current stance contrasts with his past comments. In 2017, he called Bitcoin an “index of money laundering.” His position shifted from June 2023 onward, when BlackRock filed for a spot Bitcoin ETF. In December 2025, Fink described Bitcoin as an “asset of fear.” He defined it as an asset investors buy due to concerns about currency debasement, rising public debt, and geopolitical instability.

At the World Economic Forum in Davos, Fink offered a forecast. If sovereign wealth funds allocated between 2% and 5% of their portfolios to Bitcoin, the price could reach $500,000 to $700,000. Given the total assets of these funds, an allocation in that range would generate new demand of $260 billion to $650 billion for the asset.

Fink’s confirmation of systematic accumulation by sovereign funds signals a shift in Bitcoin’s institutional perception. The participation of these long-term investors reinforces its role as a component within global asset allocation.