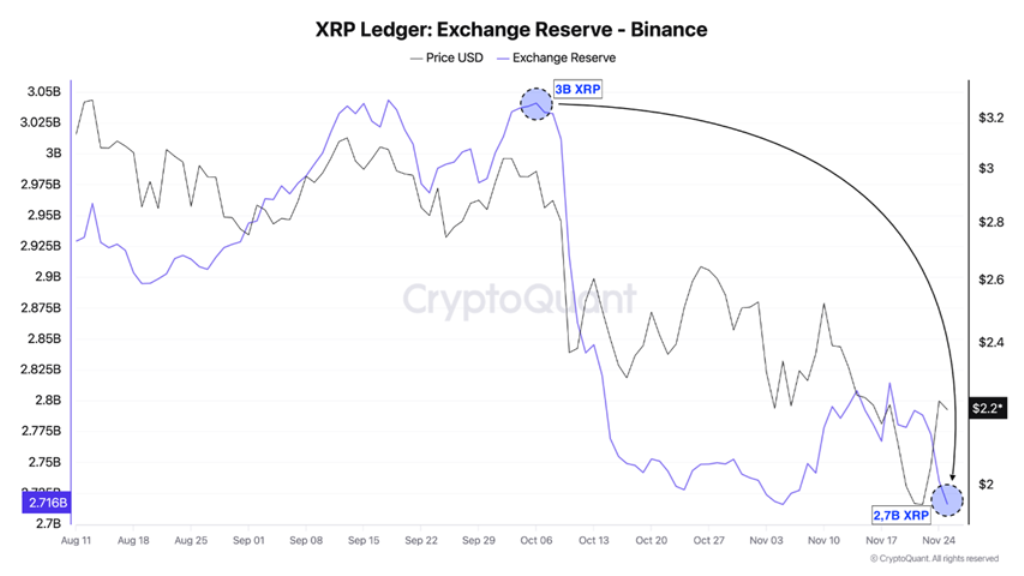

Binance reduced its XRP reserves by 310 million tokens over seven weeks, falling from 3.02 billion to 2.71 billion, equivalent to approximately $640 million. The current withdrawal pace, of 45 to 55 million tokens per week, suggests that the exchange could reach 2.55 billion before the end of the year.

The sustained decline coincides with the arrival of the first U.S. spot XRP ETFs, including products from Canary Capital, Franklin Templeton, Bitwise, and Grayscale, which could generate additional institutional demand. Part of the withdrawals reflects investors’ intention to move tokens to private wallets, indicating long-term holding interest.

If reserves fall below 2.6 billion while ETF flows exceed $50 million per week, XRP could return to trading between $2.60 and $2.75, and even approach $3 faster than expected. This combination of factors creates a potentially favorable scenario for the token’s price.

Disclaimer: Crypto Economy Flash News are based on verified public and official sources. Their purpose is to provide fast, factual updates about relevant events in the crypto and blockchain ecosystem.

This information does not constitute financial advice or investment recommendation. Readers are encouraged to verify all details through official project channels before making any related decisions.