TL;DR

- Bitcoin dropped to a seven-month low of $80,000, losing more than $27,000 from its November 11 peak.

- BlackRock IBIT recorded withdrawals of $355.5 million, pushing weekly outflows to $1,455.2 million.

- Owen Gunden liquidated $1.3 billion in BTC since October, including $230 million transferred to Kraken yesterday, increasing downward pressure on the market.

Bitcoin plunged again this morning, hitting a floor of $80,000 on most exchanges, its lowest level in seven months.

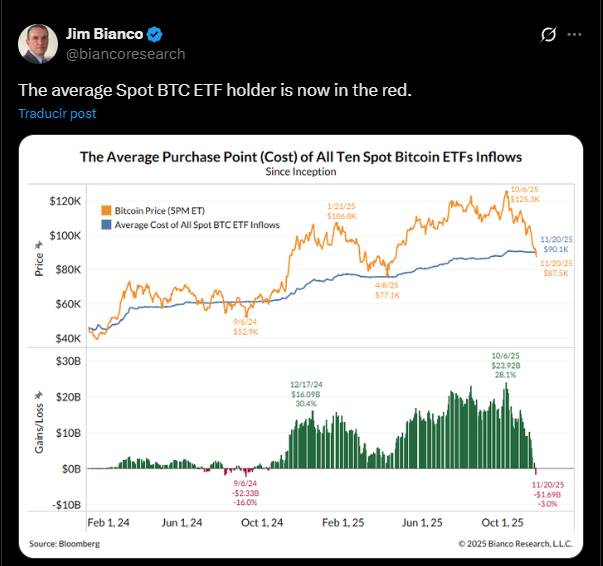

In just ten days, BTC lost more than $27,000 from its $107,000 high on November 11. This decline has left the average BTC ETF investor in the red, according to data from Bianco Research.

ETFs reflect the market pressure. BlackRock (IBIT) recorded withdrawals of $355.5 million yesterday, while net daily flows across all ETFs reached $903.2 million, according to FarSide.

ETFs and Japan Drive Bitcoin’s Drop

After a brief pause on Wednesday with net inflows of only $75.4 million, withdrawals resumed at full speed, bringing total weekly outflows to $1,455.2 million. IBIT set a record for outflows over the past four trading days, with $1.09 billion withdrawn, and JPMorgan noted that this exodus is directly contributing to BTC’s price decline.

This morning’s pullback may also be linked to macroeconomic news from Japan. Prime Minister Sanae Takaichi approved a $135 billion stimulus package to ease the impact of inflation on households and boost economic growth. Shortly after the announcement, BTC fell again, suggesting that investors are adjusting their positions in response to shifts in monetary and fiscal policy.

Whales Add Pressure to the Market

Whale activity is also evident on-chain. Arkham Intelligence reported that Owen Gunden sold all of their BTC holdings since October, valued at approximately $1.3 billion. The last transaction occurred yesterday, when $230 million was transferred to Kraken. These moves indicate that some long-standing market participants are liquidating significant positions amid the ongoing price decline.

The outlook for Bitcoin remains challenging amid persistent volatility. The combination of massive ETF withdrawals, unexpected macroeconomic developments, and large-holder liquidations is increasing downward pressure on the price. Analysts debate whether bears now fully control the market, while retail and ETF investors adjust strategies to limit losses