TL;DR

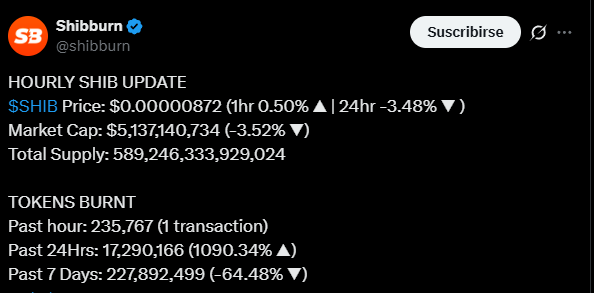

- Shiba Inu’s network burned 17,290,166 tokens in 24 hours, a jump that pushes the daily rate up more than 1,090%.

- The community removed 227,892,499 tokens over seven days, a figure that lowers the weekly burn rate by 64.48% and signals a one-off spike rather than a sustained trend.

- Market conditions intensified pressure on the memecoin, which fell toward $0.058927.

Shiba Inu’s network recorded an unusual acceleration in its burn activity over the last 24 hours. Data from Shibburn shows that 17,290,166 tokens were destroyed, a volume that pushes the daily burn rate above 1,090% and marks one of the highest recent peaks.

Weekly activity points to a different pattern: the community removed 227,892,499 SHIB in seven days, a figure that reduces the weekly burn rate by 64.48% and suggests a one-time event rather than a long-term trend.

SHIB’s price remains under pressure. The token dropped 9% over the last week and extends the downward sequence that began on November 11, when it reached $0.00001026. Since then, it has logged six negative sessions out of seven and marked a recent low at $0.00000845. This dynamic reflects broader market conditions, as the correction directly affects assets with higher exposure to retail sentiment. The token’s current price is $0.058927.

Bitcoin Wipes Out Its Gains and Drags Altcoins Like SHIB

Bitcoin fell below $90,000 for the first time since April and erased all its 2025 gains. Its decline pulled a wide range of altcoins lower and altered metrics tied to risk appetite. Pressure increased as well due to macroeconomic factors: a reduced likelihood of a rate cut in December and stocks rolling over from recent highs. That combination discourages leveraged positions and amplifies forced moves across the market.

Liquidations confirm the scale of the adjustment underway. Over the last 24 hours, more than $1.03 billion in positions were unwound, including $726.52 million in longs and $308.22 million in shorts, according to CoinGlass. In early October, the market absorbed more than $19 billion in liquidations and lost more than $1 trillion in value. Short-term signals suggest that traders are avoiding risk while the market tries to locate a stabilization point.

According to Bitfinex analysts, capitulation among short-term holders could push prices closer to a local bottom. In SHIB, the burn acceleration acts as a secondary indicator of community activity. This adjustment unfolds alongside a market that is reassessing expectations and trying to determine whether current weakness forms a new range or signals another leg down