TL;DR

- Coinbase is defending stablecoin reward programs and pushing back against banking associations seeking to expand the GENIUS Act’s interest prohibition.

- Banks want to treat discounts and third-party benefits as interest, something the exchange considers illegal and harmful for stablecoin-based payment adoption.

- The company argues that stablecoins can cut more than $180 billion in card-fee costs and warns that excessive limits could hurt both users and merchants.

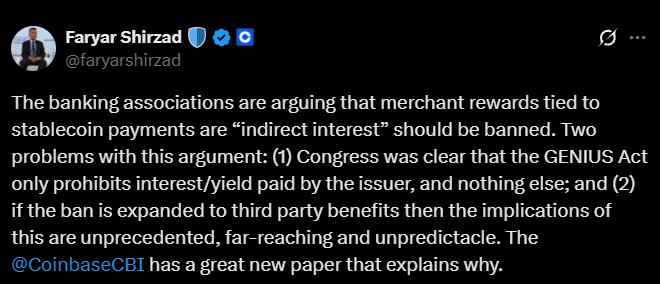

Coinbase is pushing back against banking associations that aim to broaden the GENIUS Act’s interest ban to cover stablecoin reward programs.

The company accuses banking lobbyists of trying to classify merchant discounts and third-party perks as “indirect interest,” a move that, according to Coinbase, exceeds the legal boundaries set by Congress and could stall innovation in digital payments.

Banks Move to Slow the Arrival of Stablecoins

Coinbase’s Chief Policy Officer, Faryar Shirzad, explained that the law only prohibits interest paid by regulated stablecoin issuers, making no reference to third-party rewards or indirect benefits. The firm warns that expanding the definition would create “unprecedented, far-reaching, and unpredictable” consequences, affecting consumers and small businesses offering stablecoin-linked incentives.

Banking associations, led by the American Bankers Association and 52 state-level groups, sent letters to the U.S. Treasury proposing that any economic benefit, direct or indirect, be classified as prohibited interest. Their analysis suggests the rule could weaken community banks’ lending capacity, reducing credit to small businesses by up to $110 billion and agricultural financing by $62 billion due to accelerated deposit outflows.

Coinbase Could Help Reduce Card-Fee Costs

Coinbase defended its position by noting that U.S. merchants paid more than $180 billion in card fees in 2024—costs that stablecoins could help reduce through rewards and discounts. The company argues that treating these programs as prohibited interest would redraw the clear boundaries outlined by Congress and slow adoption of more efficient payment systems.

Meanwhile, Coinbase is expanding in the United Kingdom with a savings account offering a 3.75% AER through ClearBank, with FSCS coverage up to £85,000. The product targets competition with traditional banks such as HSBC and NatWest, which currently offer between 1.15% and 3.5%, and comes alongside the Bank of England’s proposal to cap individual stablecoin holdings at £20,000. The company warns that such restrictions could discourage adoption, weaken the pound’s competitiveness, and limit stablecoin utility in wholesale markets.

Coinbase also argues that most stablecoin demand comes from outside the United States, an important driver of the dollar’s expanding global dominance. Analysts project that more than $1 trillion could flow from emerging-market banks into these digital currencies by 2028