TL;DR

- Aave Labs launched Push in Europe after obtaining MiCA authorization in Ireland, enabling it to offer regulated services across the entire EEA.

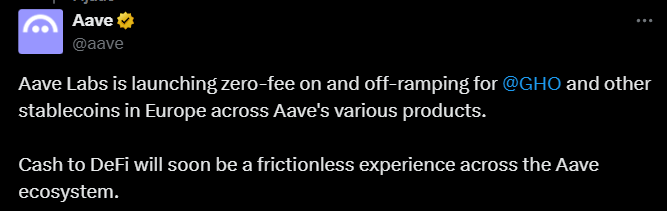

- Push allows users to convert euros into cryptocurrencies, including its native stablecoin GHO, with no fees, reducing reliance on centralized exchanges.

- The MiCA approval reinforces Ireland’s position as a regulatory hub and paves the way for other DeFi protocols to operate legally in Europe.

Aave Labs carried out the launch of Push in Europe. The platform serves as its euro-to-crypto conversion service. This became possible after Aave obtained authorization under the MiCA framework from the Central Bank of Ireland. The license was granted to Push Virtual Assets Ireland Limited, a fully owned subsidiary of the company, allowing it to provide regulated services throughout the European Economic Area (EEA).

Push enables users to convert euros into cryptocurrencies, including its native stablecoin GHO, with no fees. The platform aims to eliminate friction in fiat on-ramps and reduce reliance on centralized exchanges for stablecoin access within Aave’s DeFi ecosystem. The company has not clarified whether the zero-fee model will be permanent, but the approach gives it a pricing advantage over traditional financial providers and exchanges.

The launch in Ireland reinforces the country’s role as a regulatory hub for digital finance in Europe. European regulators are showing increased openness to DeFi firms participating in the financial system, as long as they meet MiCA’s legal and auditing standards.

Aave Becomes a Regulatory Hub for Digital Finance

Push provides a direct path for users and developers to access stablecoins under a clear legal framework. This is especially relevant given the growth of stablecoin use in lending, yield farming, and institutional liquidity.

MiCA authorization makes Push one of the first DeFi-native services in Europe to offer legally compliant stablecoin ramps, setting a precedent that could encourage other protocols to operate under European regulation. The platform initially focuses liquidity on euros and GHO, but the infrastructure could allow future expansion to other tokenized assets as the regulatory framework evolves.

The global stablecoin supply exceeded $300 billion in 2025, with a significant portion circulating within Aave. Push aims to ease the transition of traditional users into DeFi with transparency, liquidity, and regulatory security, while Aave’s main protocol maintains its decentralized and permissionless operation on public blockchains worldwide