TL;DR

- Fidelity attributes Bitcoin’s recent weakness to gradual selling by long-term holders, despite steady buying from ETFs and corporations.

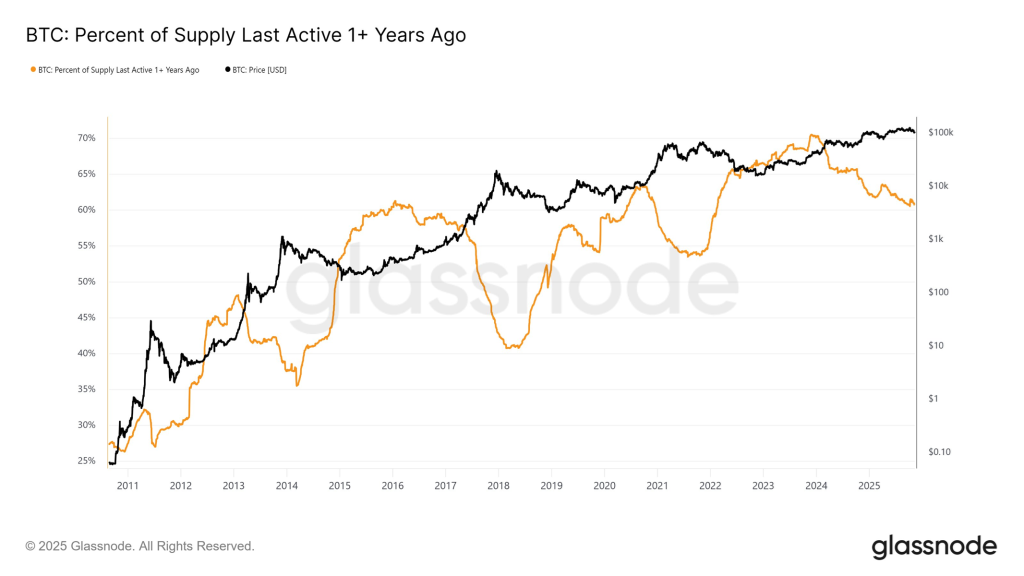

- On-chain data shows a slow decline in the share of coins inactive for over a year, signaling a controlled profit-taking phase rather than a mass capitulation.

- The price stagnation reflects market fatigue after an uneventful October, as many investors adjust positions ahead of the year-end.

Bitcoin failed to sustain its momentum after reaching a new all-time high on October 6. Its price dropped below $100,000 and entered a sideways phase that has puzzled the market. According to Fidelity, the cause is not a lack of institutional demand but rather gradual selling by long-term investors.

Fidelity Focuses on Long-Term Holders

Chris Kuiper, Vice President of Research at Fidelity, explained that steady buying from ETFs and corporations hasn’t been enough to offset the slow selling by veteran holders. On-chain data shows that the percentage of coins inactive for more than a year has been slowly declining, unlike the sharp drops that typically marked previous cycle peaks. This time, the process is more controlled — long-term holders are selling without urgency, gradually adjusting their positions.

This marks a break from Bitcoin’s classic market pattern. In past cycles, large sell-offs by long-term holders usually coincided with euphoric peaks. Now, the decline is more subdued, reflecting gradual disengagement rather than capitulation. Kuiper describes it as a “slow bleed” that offsets institutional demand and limits the recovery in price.

Bitcoin Underperforms Gold and the S&P 500

The psychological factor also matters. Many investors expected a strong rally in October and November — months that are historically bullish — but the lack of such a move led to fatigue. Bitcoin has underperformed both gold and the S&P 500, prompting some investors to secure profits ahead of year-end through portfolio and tax adjustments.

According to Fidelity, this orderly selling could extend short-term weakness but doesn’t change Bitcoin’s positive fundamentals. The firm plans to keep monitoring on-chain metrics for signs of seller exhaustion, as BTC’s price remains disconnected from the ongoing growth in adoption and institutional infrastructure.